Welcome to two of the best-performing projects for this bull run. You know already how much I like Solana. Many Altcoin Buzz members, including myself, have been following Solana since its beginning. I enjoyed its current ATH of $260. On the other hand, it was devastating to see it drop back to $8 in December 2022. Only to rise again like a phoenix. Currently, it’s around a $150 price tag. Most likely on its way to crushing its previous ATH.

However, there’s a new kid on the layer 1 block. This could well be taking over Solana’s role during the 2021 bull run. That’s where $SOL went from $3.50 to $260. That’s a 74x. Please welcome Sui. Over the last 14 days, it’s been up by nearly 100%. And its run is not anywhere near stopping in this market. $SUI is on fire, and you want to pay attention. So, my question is, can Sui dethrone Solana? So, Sui vs Solana: can Sui pass the retail leader?

Sui vs Solana, How Do They Compare?

Sui and Solana are both layer 1 chains. Solana has been around since March 2020. It’s named after Solana Beach, a city in San Diego County. On the other hand, Sui launched its token in April 2023 and its mainnet in April 2023. Sui means ‘water’ in Japanese.

Sui has a different technical setup compared to Solana. It all starts with their coding language, Move. This dates back to when the Sui team still worked at Meta. It was part of the now defunct Diem blockchain development team.

That’s where the Move language originates from. Aptos is another chain that uses this programming language. However, it’s still different compared to Sui.

So, this allows for a different technical architecture of the Sui chain. For example, the Sui chain has an object-centric nature. It uses objects. This means that you don’t need smart contracts to track ownership. These objects also have clear attributes.

Introducing ephemeral shared objects on Sui, providing builders the option to create shared objects that delete themselves, earning storage rebates and allowing complex use cases.

Learn more in our latest blog: https://t.co/XjAUODKpQ0

— Sui (@SuiNetwork) February 23, 2024

For example, it defines ownership. As an object owner, you’re in direct control of your objects. The objects store data. This is of interest for NFTs or tokens. If you want to know more about the Sui objects, we have an article about them available.

Another part of its architecture is the parallel transaction execution. This allows a network to process many transactions at the same time. As a result, it’s much faster compared to linear standards, like Solana.

Consensus Mechanisms

In May, Sui launched Mysticeti. This is an upgrade to its consensus mechanism. Among other things, it makes transactions much faster. It reduced latency to 390 milliseconds. In other words, transactions are almost instant. Solana didn’t stay behind and launched the Firedancer upgrade. Among other things, it will make Solana more decentralized.

Learn more about Mysticeti: https://t.co/j8WCqFPpWh

— Sui (@SuiNetwork) July 25, 2024

Sui now also has a theoretical 297,000 TPS (transactions per second). Solana can currently reach 65,000 TPS. However, Firedancer could be gearing up to 1 million TPS.

Is Solana on the Back Burner?

Solana is by no means on the back burner. It has an established and very much alive ecosystem. It’s been around since 2020. Hence, it has a fair advantage over Sui regarding the number of projects in each ecosystem.

Solana has around 2000 coins and probably more projects in its ecosystem. In contrast, Sui, as the newer kid on the block, has almost 90 projects in its ecosystem. It has 53 coins listed as being inside that same ecosystem. No wonder, when looking at the age of each ecosystem. Sui vs Solana, 1 vs 4 years.

Solana has two ETFs coming up in Brazil. However, both still need to get approved by the stock exchange B3. An ETF is an exchange traded funds. They track an asset’s price, and you can trade them on traditional exchanges. However, in the US, fund managers withdrew their ETF applications.

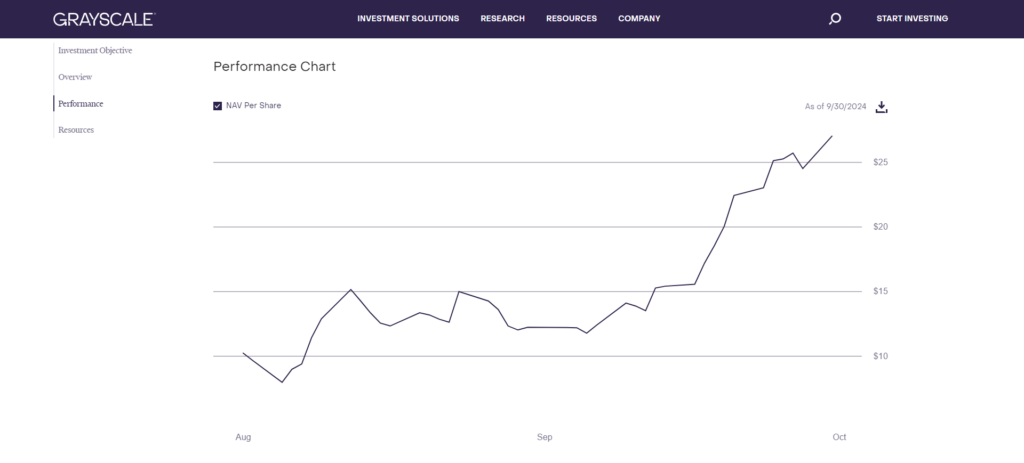

On the other hand, Sui has an ETP in Europe with 21Shares. You can find it on the Amsterdam and Paris exchanges. Furthermore, Grayscale started a Sui Trust which has been performing very well. And approval for anything in the US is a big deal.

Source: Grayscale Sui Trust

DeFi

Solana has a thriving DeFi and meme coins ecosystem. In DeFi, Solana has a TVL of $5.5 billion. It takes the third spot measured by TVL. Sui already comes in at 7th spot with $1 billion in TVL. However, Sui gained almost 74% in TVL over the last 30 days and Solana only 11%.

Sui’s DeFi ecosystem is small, but fine. It only has 40 DeFi projects compared to Solana’s 164. Sui’s current top DeFi protocols are,

Navi Protocol ($NAVX)

Cetus ($CETUS)

And Scallop ($SCA)

These are also 3 coins to follow closely. They’re on fire! Solana’s top projects are Jito, Kamino, and Jupiter. Another 3 coins to keep an eye out for.

Sui vs Solana Is also $SUI vs $SOL

The current $SUI price is $1.80. Its market cap is $4.5 billion. However, out of the 10 billion max and total supply of $SUI, only 2.7 billion circulate. That’s a weak point. Sui still has plenty of token unlocks to come. In early October, there’s a 64.19 million $SUI token unlock.

The current $SOL price is $156.49 with a $70.9 billion market. However, $SOL has an unlimited supply. There’s a 585 million total supply and 468 million $SOL circulate. So, these tokenomics aren’t also the greatest. Every day there’s a 74.86k $SOL emission. At current rates, that’s $11 million per day.

But, let’s look at the growth potential here. Solana currently has a market cap of 16x over Sui. So, $SUI needs to do a 16x to get to the same market cap.

However, in the bull run, Solana will also grow. A new ATH, at $300, gives it twice the current market cap. So, I see much more potential for $SUI to grow at least 16x than $SOL. The picture below shows $SUI in red and $SOL in blue.

Source: Coindx

To sum this up, Solana is still on top of this ‘battle’. It’s bigger in many ways. However, Sui does have the momentum. Sui won’t be dethroning Solana during this bull run. However, it may well be the like Solana during the 2021 bull run.

Sui will be making waves and grow. It’s still young and has to prove a thing or two. Nonetheless, I can see Sui easily entering the top 20 measured by market cap. Don’t be surprised if it also tries to enter the top 10.

So, what do you think of Sui? Does it have the ingredients to dethrone Solana?

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Sui vs Solana: Can Sui Pass the Retail Leader? appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.