This is the third part of this article. Here is the second part.

A recent survey by Grayscale shows how voters perceive investment behaviors and the influence of crypto on their political outlook.

Let’s break down these crypto-related insights in a way that’s easy to digest!

Investment Behaviors and Outlook

The data shows that 74% of likely voters own some form of asset, and 21% of them have tried Bitcoin and other digital currencies. What’s interesting is that those who own crypto are also more likely to invest in traditional assets and exchange-traded funds (ETFs).

When it comes to future investments, more than 20% of voters are thinking about buying crypto, which puts it right behind real estate and bonds. And among current crypto owners, there’s a more optimistic outlook. 1 in 5 views crypto as a solid long-term investment. It seems like Bitcoin is leading the charge here!

Another noteworthy point is the impact of inflation. 63% of Bitcoin owners say rising inflation has piqued their interest in owning Bitcoin. They see it as a safeguard against future economic uncertainty.

Source: Grayscale Report

Crypto as an Investment Vehicle

The survey also shows how much the voters know about cryptocurrency. 53% said that they have come across it, but 93% of those who own or use crypto have a working knowledge of it. Crypto users engage in a lot of activities. Advertising crypto projects in the media or their online platforms is one activity that most voters engage in. The other activity that most voters engage in is researching online. An impressive 64% of crypto owners said they had bought cryptocurrency via an exchange. However, only 8% of non-owners could make the same claim.

So, what makes people invest in cryptocurrency? The first is investing in different types of securities to reduce risk exposure. It also depends on curiosity about the technology. Again, the recommendations from friends and financial advisors act as incentives, as do exposures through social media.

However, with the growth of market risk and the absence of regulations, many potential investors keep themselves at a distance. People want more information about the topic. They want governing laws, principles, and a less volatile environment for investment.

Recent Impacts of Views on Crypto

Voters have a different concept after the adoption of Bitcoin and Ethereum ETFs. A greater proportion of voters say they are willing to invest or seek more details on crypto this year. Those who already hold the asset have been more attentive this year.

While perceptions of digital assets differ, and 97% of voters are aware of Bitcoin, only 60% of the voters are aware of Ethereum. Approval of the Bitcoin ETF has appealed to the interest of 27% of the voters with crypto knowledge.

General Demographics

62% of the likely voters are working, and they are between males and females. Based on the analysis, it is clear that both the Baby Boomers and Gen X consumers contribute a larger proportion of the demand. Millennial consumers contribute to lower demand. As for the income, less than half of the voters receive over $100,000 per year. As for the race, 63% of the population are white.

Crypto owners and non-owners hold different values when deciding on ‘who to vote for.’ They tend to focus more on community engagement, social status, and religious values. Non-owners emphasize financial stability and personal safety.

B of A: The 2024 US election is the “first in past 30 years when Boomers [are] no longer [the] majority voting bloc .. a new ‘era’ as 65 million Gen Z & Millennial voters ‘Swiftly’ set to outnumber 50 million Boomers ..” #Election2024 pic.twitter.com/sp7NBG13fW

— Carl Quintanilla (@carlquintanilla) September 13, 2024

Crypto in the Political Arena

Cryptocurrency emerges as a pertinent campaign topic as we gear up for the election. Voters care about how candidates will tackle crypto-related issues with more concern for the users. By comparison, non-owners are likely to care about topics such as national security and inflation rates.

That is the extent to which inflation is a concern to many potential voters, especially Republican and Hispanic voters. They want candidates to engage with the economy and tackle job loss.

In this weeks video I discuss how almost half of all corporate money contributed to this year’s US election campaigns has come from the crypto industry. pic.twitter.com/iCnvHwSOB9

— Patrick Boyle (@PatrickEBoyle) October 1, 2024

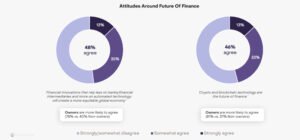

Trust and the Future of Finance

Crypto owners exhibit a higher level of trust in emerging technologies compared to non-owners. They believe blockchain and AI technologies will improve the finance system and promote job creation.

Opinions about which political party is better for crypto vary. 42% of crypto owners lean towards the Republican Party, while 45% favor the Democrats.

Conclusion

Cryptocurrency is more than a buzzword—it’s about to change our financial system as we approach the 2024 election. Whether you’re a crypto investor or a newbie, one thing is clear: crypto will continue to be a key player in both investment discussions and political debates in the years ahead.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Grayscale Report: The Role of Crypto in the 2024 Election—Part 3 appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.