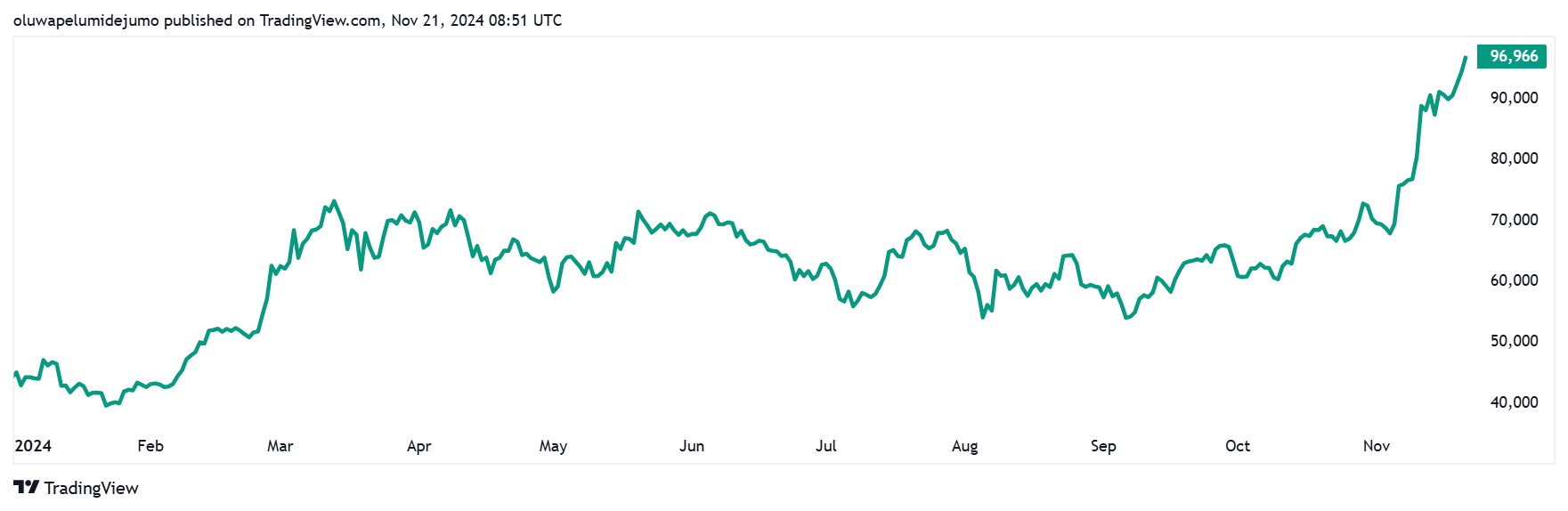

Bitcoin’s relentless rally has taken the leading digital asset to new heights, surpassing $97,000 to reach a new all-time high of $97,862.

This surge, ignited by a broader wave of optimism following Donald Trump’s recent political victory, has positioned Bitcoin just inches from the highly anticipated $100,000 mark. Reaching this milestone would be pivotal for the top asset, further cementing its status in the broader financial industry and pushing its market capitalization beyond the $2 trillion mark.

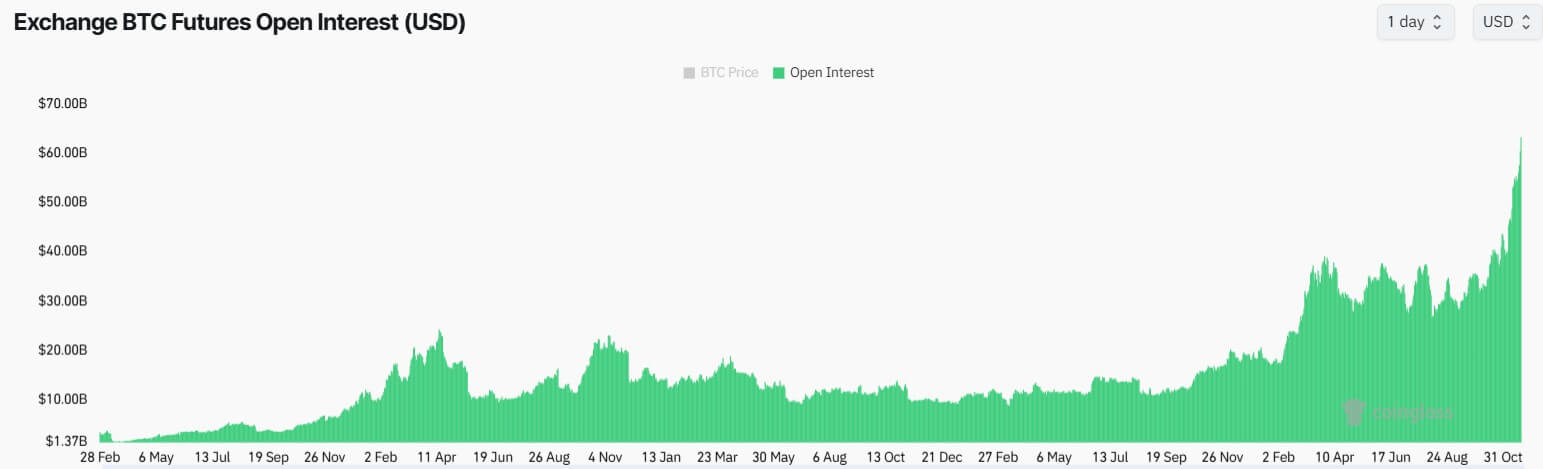

The derivatives market is playing a central role in this bull run. According to Coinglass data, Bitcoin’s Open Interest has climbed to $63 billion, a historic high that marks a 147% increase in market leverage compared to its 2021 peak of more than $20 billion. At that time, Bitcoin’s price hit an all-time high of around $69,000.

However, the current market trends present risks. The growing leverage in derivatives amplifies volatility, making the market more susceptible to sharp price swings.

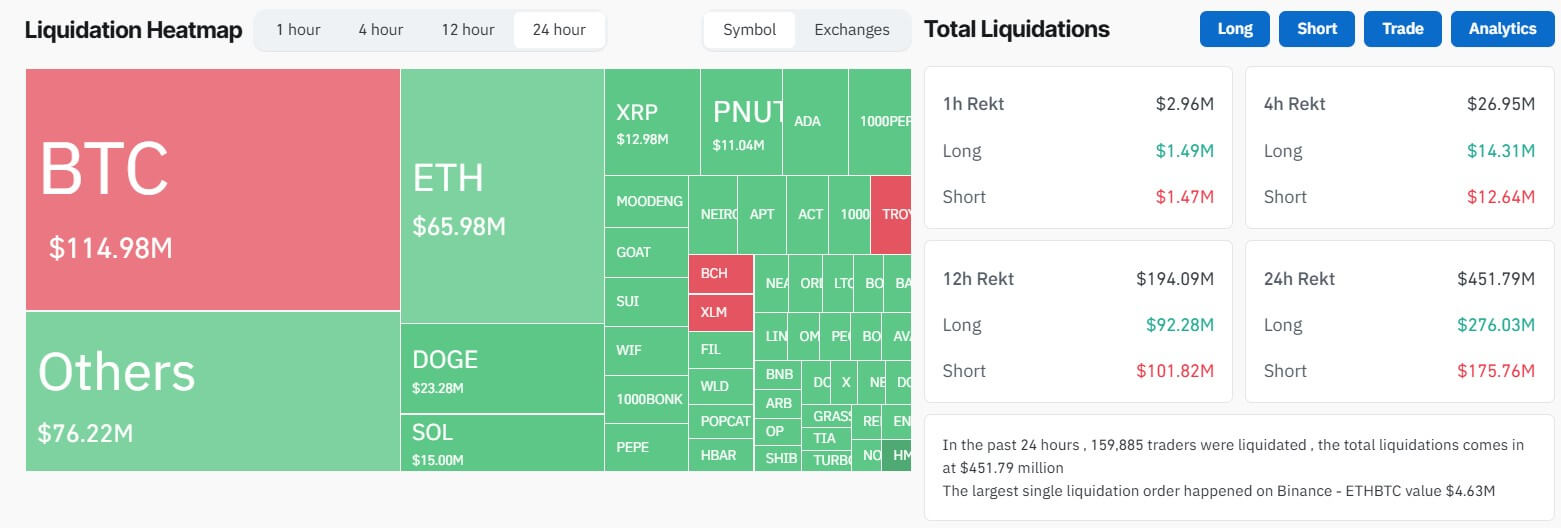

Already, Bitcoin’s price fluctuations have triggered industry-wide liquidations exceeding $450 million over the past 24 hours. Of these, 60% came from short positions, indicating significant losses for traders betting against the rally.

As Bitcoin edges closer to the six-figure milestone, market participants should remain cautious amidst heightened volatility.

The post Bitcoin surges to $97k as market leverage hits historic $63 billion appeared first on CryptoSlate.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.