As February began, crypto investors found themselves inside a turbulent market after the digital asset space went crashing down, leading to more than $2 billion in crypto liquidations and Bitcoin price plunged near the $90,000 mark.

Analysts attributed the current turmoil in the cryptocurrency sector to the new tariffs imposed by President Donald Trump on Canada, Mexico, and China, raising questions on what would be the long-term impact of the tariffs on digital currencies.

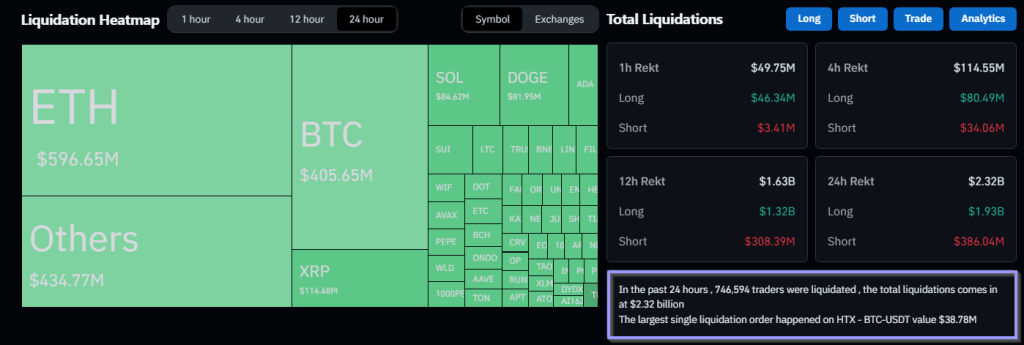

$2 Billion In Crypto Liquidations

Trump said in a statement that the US is eyeing to implement heftier tariffs on its three largest trading partners, Canada, Mexico, and China, a measure that sent shockwaves in the cryptocurrency community.

Market observers believe that Trump’s announcement fueled the crash across the cryptocurrency sector, which saw massive leverage liquidations among virtual currencies.

According to Coinglass, more than $2 billion in crypto liquidations were recorded in the 24 hours after the planned new tariff was announced by the US President.

Data also showed that the prices of the top-tier cryptocurrencies plunged after traders found themselves in a turbulent market after the tariff announcement. Bitcoin plummeted to $95,200, according to CoinGecko, the lowest price the firstborn crypto has been in three weeks.

Meanwhile, Ethereum went down to about $2,800, wiping out all the gains it made since early November.

“In the short term, we’ve bottomed. Market makers have used this tariff news cycle to sweep the leveraged longs and there is now very little liquidity worthy of pushing price lower,” crypto fund manager Merkle Tree Capital chief investment officer Ryan McMillin said in an interview.

Tariffs Might Trigger An Inflation

Analysts said that many investors are worried that the new tariff would contribute to inflation which could impact sentiments on digital assets.

“Crypto is really the only way to express risk over the weekend, and on news like this, crypto resorts to a risk proxy,” Pepperstone head of research Chris Weston said.

Nick Forster, founder of Derive, a DeFi derivatives protocol, believes that Trump’s new tariff would more likely push inflation up, dampening investor sentiment in cryptocurrencies.

“We’re already seeing signs of heightened market volatility, as BTC’s 30-day implied volatility has risen by 4% to 54% in the wake of these tariffs and the broader economic uncertainty,” Forster said.

The DeFi derivatives protocol founder added that he expects that this volatility would persist as “more negative catalysts likely unfold in the coming weeks.”

A Bitcoin Boom?

Bitwise Asset Management’s head of alpha strategies Jeff Park suggested that a Bitcoin boom might be a potential positive effect of Trump’s tariff policies.

Park explained that the new tariffs might weaken the US dollar, creating a favorable condition that could drive growth for Bitcoin, saying that as tariffs increase inflation, it would affect both domestic consumers and international trade partners, which might drive the residents of foreign nations toward BTC to counter currency debasement.

Featured image from Getty Images, chart from TradingView

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.