Ethereum slipped 2% to $4,457 in early trading after SharpLink Gaming (SBET) posted a sharp $103.4 million quarterly net loss. The setback came even as the company expanded its Ethereum holdings to 728,804 ETH, worth more than $3.2 billion, marking its first financial report since pivoting to an ETH-focused treasury strategy in June.

SharpLink Grows ETH Treasury Despite Losses

SharpLink raised more than $2.6 billion through offerings to build its Ethereum reserves, deploying nearly all holdings into staking and earning 1,326 ETH in rewards.

This move was reinforced by high-profile leadership changes, including Ethereum co-founder Joseph Lubin joining as chairman and former BlackRock executive Joseph Chalom taking over as co-CEO.

The company also struck a partnership with Consensys, recording $16.4 million in stock-based compensation tied to advisory services. Chalom highlighted the rapid progress of the strategy, stating the firm had scaled its ETH position “in a highly accretive manner.”

However, revenue for Q2 2025 fell 30% year-over-year, sliding from $1.0 million to $0.7 million, while gross profit stood at just $0.2 million. Losses were driven by an $87.8 million non-cash impairment on liquid staked ETH, a requirement under U.S. GAAP to mark down assets at their lowest traded value—$2,300 per ETH during the quarter.

Despite these accounting losses, SharpLink stressed that no ETH had been sold or redeemed, underscoring its commitment to a long-term Ethereum treasury model.

Market Impact and Ethereum’s Price Outlook

Following the announcement, SharpLink’s shares fell 15% to $19.85, while Ethereum showed heightened volatility. In the broader market, futures liquidations reached $169 million in the past 24 hours, reflecting ongoing caution among investors.

Analysts suggest SharpLink’s ETH-heavy strategy highlights a high-risk, high-reward model. While large ETH reserves and staking yields provide long-term upside, they have yet to offset near-term revenue declines and impairment-driven losses.

Ethereum is being tested. Technicals say support at $4,100, if it fails that’s $3,500. If it holds above $4,350 it’s a green light for higher.

Ethereum Technical Analysis: Key Levels to Watch

Ethereum price prediction is bullish as ETH is currently trading near $4,405, consolidating within an ascending channel that underscores its bullish longer-term structure. The 50-period SMA at $4,379 and channel support between $4,350–$4,400 form a critical demand zone. A rebound here could validate continuation toward $4,785, with the upper channel boundary extending near the psychological $5,000 mark.

- Support: $4,350–$4,400 zone; deeper floor at $4,170

- Resistance: $4,785 followed by $5,000

- RSI: 44, recovering from oversold levels

- MACD: Negative but weakening, signaling fading bearish pressure

Traders may look for a bullish engulfing candle above $4,450 as confirmation of renewed upside momentum. A sustained breakout could accelerate Ethereum’s path toward $5,000. However, a close below $4,170 risks invalidating the channel, opening downside targets toward $3,950.

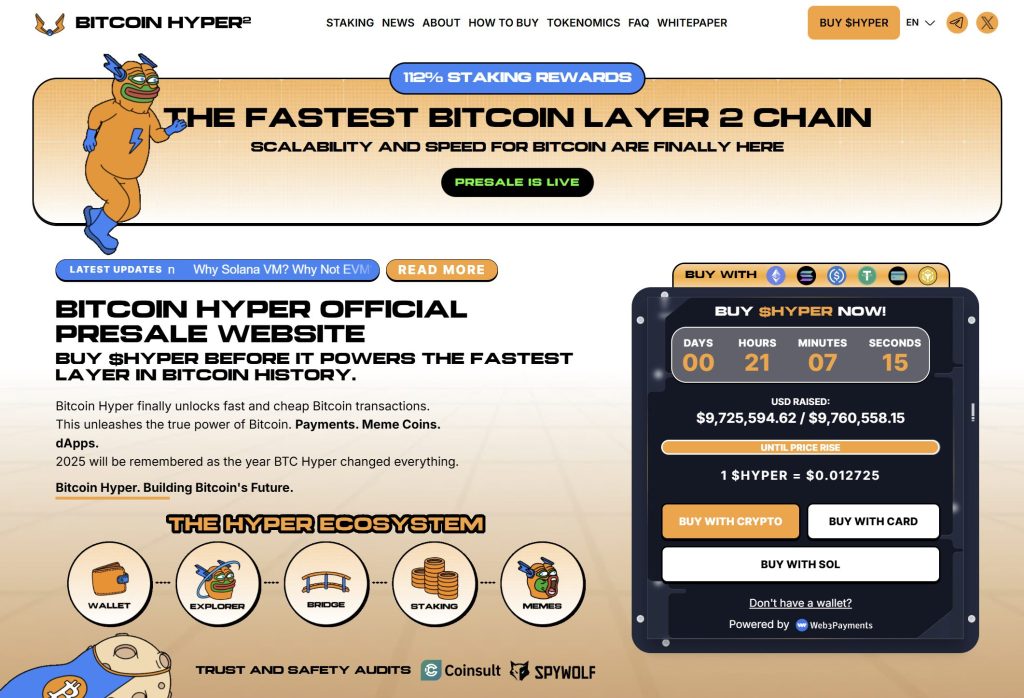

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $9.7 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012725, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: Will SharpLink’s Massive ETH Holdings Offset Revenue Decline? appeared first on Cryptonews.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.

(@CryptoGucci)

(@CryptoGucci)  Total Raised: $2.6B

Total Raised: $2.6B