Prediction markets had themselves another lively week. Kalshi rolled out shiny new NFL contracts even as lawyers kept filing lawsuits faster than you can say “parlay.”

This time it was a second tribal challenge, aimed at keeping Kalshi off tribal lands. But the real twist came from the NCAA, which finally peeked its head above the parapet and muttered something about integrity and prediction markets after Robinhood launched pro and college football prediction markets through its app.

NCAA statement in response to Robinhood offering college football prediction markets:

“Sport integrity is paramount for the NCAA, and we are deeply concerned by unregulated and unprotected markets that pose a threat to competition integrity and student-athlete safety. We will…

— Pat Forde (@ByPatForde) August 21, 2025

Tim Buckley, the NCAA’s senior vice president of external affairs, gave us the usual formal statement: “Sport integrity is paramount for the NCAA, and we are deeply concerned by unregulated and unprotected markets that pose a threat to competition integrity and student-athlete safety.” He also promised that the NCAA would continue working with industry leaders to “ensure guardrails and regulations.”

That all sounds nice, until you notice a few missing ingredients. First, Kalshi is actually regulated. You may not like how it’s regulated, and you may think the CFTC is playing the role of the world’s sleepiest chaperone, but technically, it’s regulation. Polymarket, for the record, still can’t legally serve US users, so the NCAA doesn’t need to lose sleep over that part just yet.

Kalshi even has an integrity partner, IC360, though that’s a voluntary handshake, not a regulatory requirement. So when the NCAA says it wants to “work with industry leaders to help ensure guardrails,” what does that mean? Because spoiler alert – no regulations are arriving. Even if the CFTC woke up tomorrow with a sudden passion for sports contracts, we’d be years away from an actual rulebook.

So, the NCAA is left with the option of cozying up directly to Kalshi and friends. That’s not exactly a safe bet. And meanwhile, markets are moving forward anyway. What’s to stop Kalshi from offering props on college athletes? Not much. The CFTC isn’t going to gallop in on a white horse to protect March Madness. And Kalshi’s existing oversight doesn’t scream “line in the sand.”

And Polymarket isn’t about to sit this one out forever. Crypto.com even dabbled in prediction-style betting too. The NCAA’s adversaries are multiplying like heads on a hydra, and all the NCAA has brought to the fight so far is a stern press release.

To make matters worse, prediction markets aren’t the only problem knocking at the door. There’s the small matter of AI-powered “general predictive intelligence,” which sounds like the plot device from a techno-thriller but could end up turbocharging markets in ways the NCAA hasn’t even begun to imagine.

In short, the NCAA can keep wringing its hands about integrity. But unless it speeds things up, it risks becoming the organization that was “deeply concerned” while everyone else started betting on whether the quarterback would oversleep his 8 am class.

What’s on this week’s prediction markets

Kalshi

Kalshi just cannot escape Fed drama these days and the latest obsession is Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium in Wyoming, where the world’s central bankers gather to talk shop between August 21 and 23. Powell, still the Fed chair for now, has the unenviable task of explaining where the US economy is heading while President Donald Trump continues his unusual hobby of publicly undermining central bank independence.

Markets are desperate for Powell to drop hints. For five straight meetings the Fed has held rates steady, ignoring Trump’s cries for immediate cuts. Policymakers want more clarity on what the president’s tariffs, deportation pushes, and general unpredictability are actually doing to the economy. At Jackson Hole, Powell is expected to sketch the outlook, his last speech at the annual central banker jamboree before his term runs out in May.

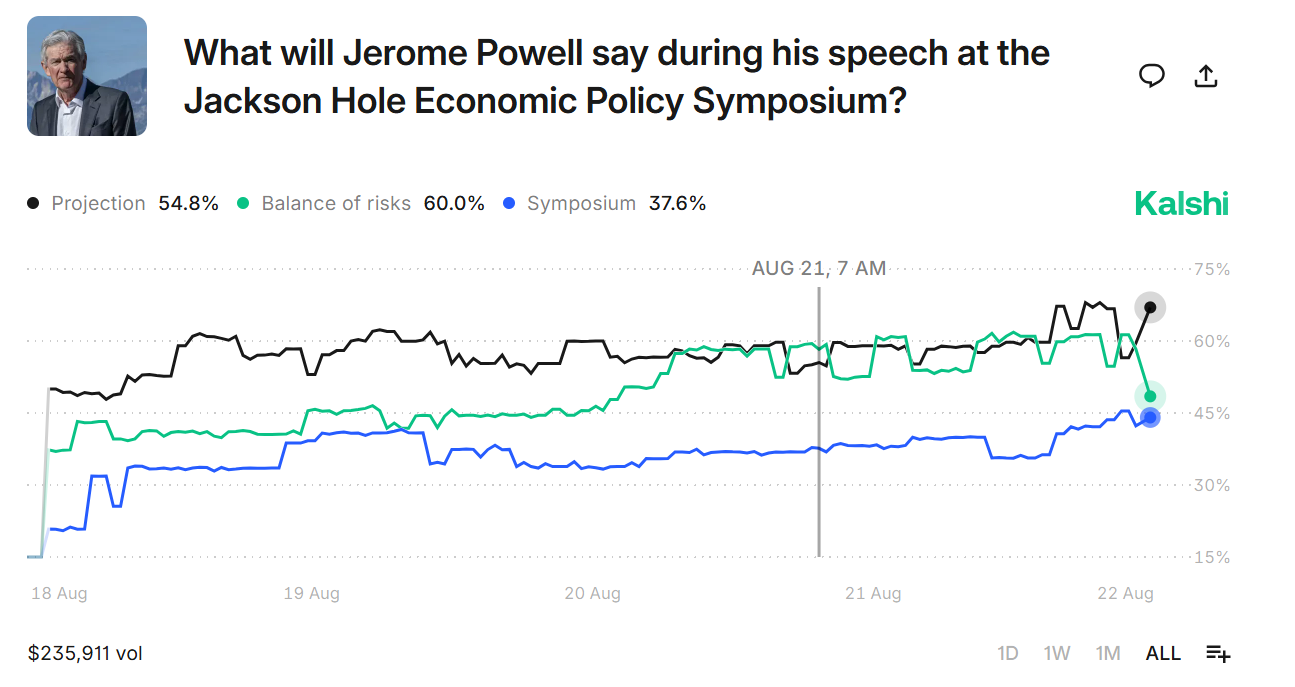

Naturally, Kalshi users are already trading on the precise words Powell will use. More than $235,000 has been staked on terms ranging from the obvious “Symposium” to the nerdy “Balance of risks.” A striking 57% of traders are betting Powell will talk about layoffs.

Meanwhile, vultures have been circling over Powell’s successor. Christopher Waller, Michelle Bowman, and Trump’s ally Kevin Hassett are all considered contenders for Powell’s chair if the musical chairs at the Fed begin in earnest.

On a side note, prediction markets are suddenly bustling with action over the next Democratic presidential nominee. California governor Gavin Newsom, despite being under fire for allegedly blocking a casino after pocketing $2 million in tribal donations, has seen his odds skyrocket. He now sits at 28%, comfortably ahead of Alexandria Ocasio-Cortez at 13%, with nearly $17 million wagered overall. Pete Buttigieg, for the moment, is jogging along in single digits at 9%.

BREAKING: Gavin Newsom’s odds to be the 2028 Democratic nominee surge to a new all time high pic.twitter.com/puUWwNpr8G

— Kalshi (@Kalshi) August 20, 2025

Newsom, it seems, has cracked open the Trump playbook. In recent days he’s posted himself atop Mount Rushmore, been prayed over by Tucker Carlson, Kid Rock, and a winged Hulk Hogan, and taken to writing in ALL CAPS on social media. “He’s trying to mimic President Trump,” Steve Bannon told POLITICO, and the markets, at least, are starting to think it’s working.

And if that weren’t enough, prediction markets are colliding with artificial intelligence. Enter Prophet Arena, a project out of the University of Chicago’s SIGMA Lab, which tests AI models not on past data but on live unresolved events, many pulled straight from Kalshi and Polymarket. “By anchoring evaluations in unresolved, real-world events, Prophet Arena ensures a level playing field,” the researchers wrote.

Introducing Prophet Arena — the AI benchmark for general predictive intelligence.

That is, can AI truly predict the future by connecting today’s dots?

What makes it special?

– It can’t be hacked. Most benchmarks saturate over time, but here models face live, unseen… pic.twitter.com/rhwR5WlU9d

— Prophet Arena (@ProphetArena) August 17, 2025

So far, machines seem to be holding their own. GPT-5 tops the leaderboard with an 82.21% Brier score, while OpenAI’s o3-mini leads in raw profits when its calls are converted into simulated wagers. Kalshi itself has been dabbling in AI, recently linking up with Elon Musk’s Grok, while Polymarket has begun spitting out AI-generated summaries of its markets.

If the machines keep improving, they could strip away all the sentiment and second-guessing that plague human traders. No gut feelings, no mood swings, just cold forecasting. In that case, the old “wisdom of the crowd” might soon have to share the stage with the wisdom of the algorithm.

Polymarket

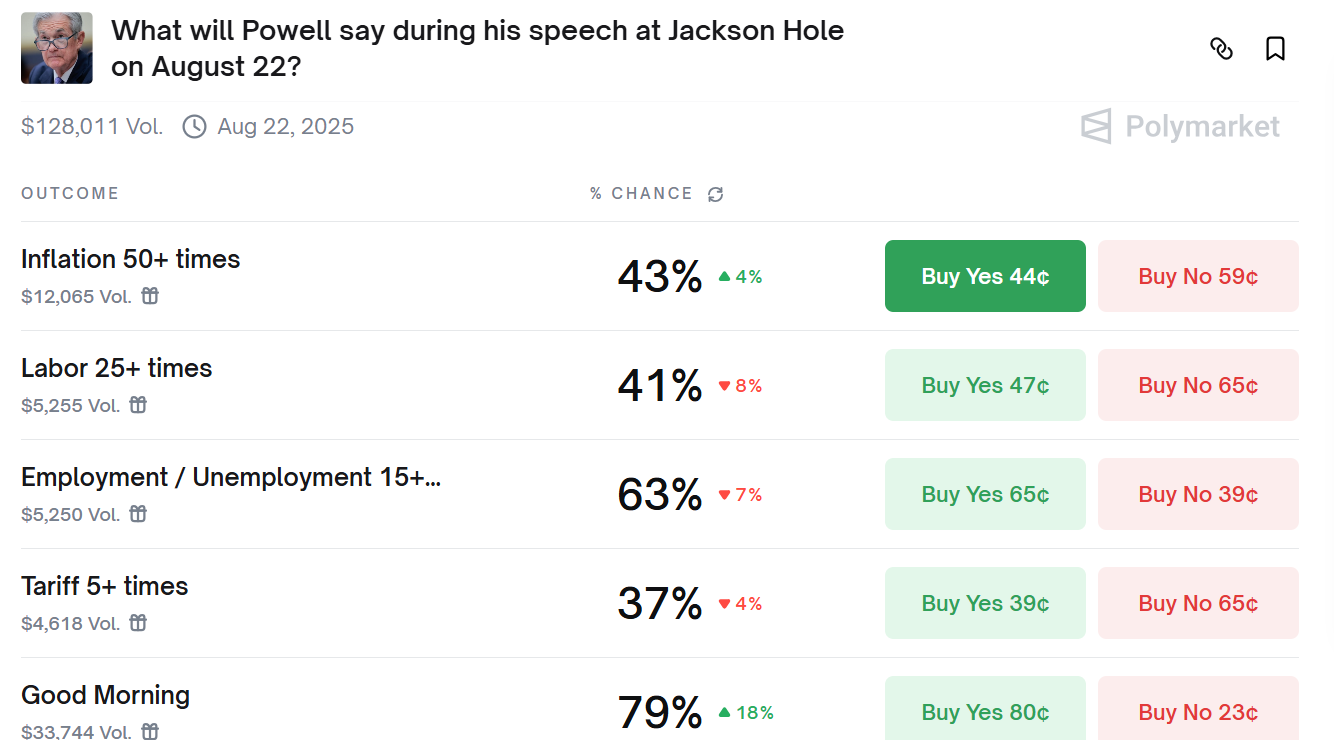

If Kalshi is keeping things buttoned-up, Polymarket is happily leaning into the spectacle of Powell’s Jackson Hole appearance. True to its social, buzzy reputation, traders have pushed the limits of what counts as a market. Roughly 83% believe Powell will mention the pandemic, 63% are betting on unemployment, and the most popular wager of all is whether he’ll bother to say “Good morning.”

Behind the cheekier bets lies the real question whether Powell’s speech will signal the Fed’s latest policy. Investors are mostly expecting a quarter-point cut in September, but as Deutsche Bank analysts warned earlier this week, the address could end up “creating uncertainty” rather than clearing the air.

Featured image: Canva / Grok

The post Prediction Pulse: Kalshi and Polymarket face competition from Prophet Arena, plus Jerome Powell’s speech appeared first on ReadWrite.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.