Vermont, a state in the Northeastern USA, dropped its case against major crypto exchange Coinbase over staking services, citing the regulatory shift in that country.

Paul Grewal, Coinbase’s Chief Legal Officer, shared the news on Twitter, saying that Vermont has “embrac[ed] progress.” The state has provided clarity for its citizens who own digital assets, he stated.

Per Grewal, the exchange has “always said: staking services are not securities.”

According to the order, the Securities Division of the Vermont Department of Financial Regulation requested the case to be dropped without prejudice.

A case dismissed without prejudice means it can be brought back to court, subject to deadlines, statutes of limitations or specific refiling periods,

Notably, the order remarked that the US Securities and Exchange Commission (SEC) announced the formation of a new task force.

The task force will, “among other things, provide guidance for the promulgation of rules regarding the regulation of cryptocurrency products and services,” the document states.

‘Seize the Bipartisan Momentum’

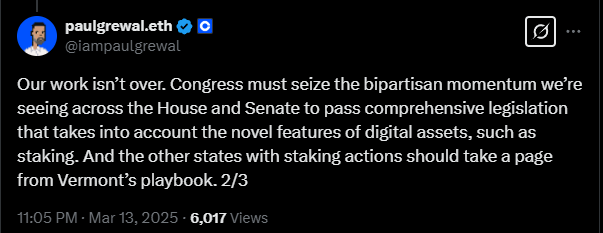

In his post, Grewal argued that Coinbase’s “work isn’t over.” He opined that the country is witnessing a “bipartisan momentum” which the US Congress must “seize” to pass comprehensive legislation for digital assets.

Asked why comprehensive legislation is relevant and what the chances are the US would see it, Grewal replied that industry needs predictable and lasting rules, even if they are imperfect.

Furthermore, the chances of getting this legislation are “pretty good.” He noted that Senator Tim Scott suggested he and others, including Senator Kirsten Gillibrand, can do it in 100 days.

Meanwhile, Coinbase paused its staking services in several US states, including Vermont, in July 2023. This was in response to legal proceedings from the SEC. The regulator had filed a lawsuit against the crypto exchange in June that year for offering unregistered securities.

In late February 2025, the SEC agreed to drop its enforcement case against Coinbase. Hence, it reversed years of legal battles initiated by former SEC Chair Gary Gensler.

This massive shift in SEC policy comes with the new presidential administration in the US. It claims it aims to ease regulatory burdens on the crypto sector.

Moreover, following this shift and the subsequent change in the SEC leadership, the regulator decided to drop several high-profile lawsuits against crypto companies. This includes Kraken, Gemini, Consensys, Robinhood, and Yuga Labs, among others.

Then, in early March, Coinbase submitted a Freedom of Information Act (FOIA) request. It asked for information on the SEC’s spending on crypto-related enforcement over the past four years.

Meanwhile, just days ago, Coinbase announced it would launch 24/7 Bitcoin and Ethereum futures trading for US traders. It will do so via its Commodity Futures Trading Commission (CFTC)-regulated derivatives exchange, Coinbase Derivatives, LLC. This will be the first time US traders can access perpetual-style futures contracts without expiration dates.

The post A Coinbase Win: US State of Vermont Drops Its Case Against the Exchange appeared first on Cryptonews.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.