Author: Fady Askharoun

Back at Google I/O, Google announced a big set of security features called Theft Protection that would be coming soon to Android. They didn’t say at the time exactly when we’d see these features, but…

Mac Studio and Mac Pro machines that are equipped with Apple’s next-generation M4 chips will be some of the last Macs to be refreshed with the new chip technology, Bloomberg‘s Mark Gurman said in this…

We’re nearing the end of the iOS 18.1 beta testing process, but Apple is continuing to make tweaks to refine built-in features ahead of when the software launches. With testing winding down, there are fewer…

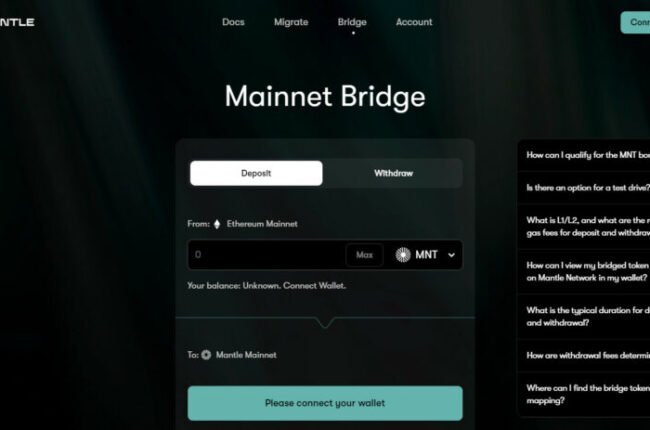

Having Ethereum in your portfolio is one thing. But how about putting your ETH to work to earn you passive income? Mantle is an L2 on Ethereum that gives you these options. Currently, they claim…

In Web3, one avenue for generating income involves selling crypto investments when the market prices surge. Another way is through staking, where you can leverage your digital assets to generate passive income without selling. But…

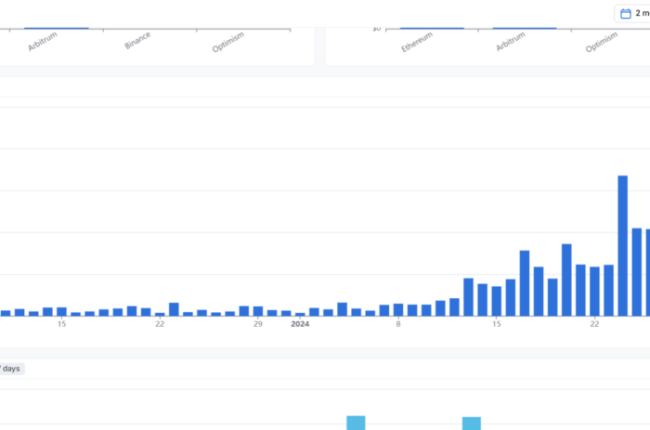

Pendle positioned itself for the coming restaking wave. This wave is about to hit crypto big time. There’s already the LRTfi space. An LRT is a liquid restaking token. To clarify, EigenLayer (EL) is the…

PARSIQ is making lots of headlines in Web3 infrastructure. We already like their API tools and their querying and data-organizing features for blockchains. Then, they launched their new Reactive Network with Reactive Smart Contracts. This…

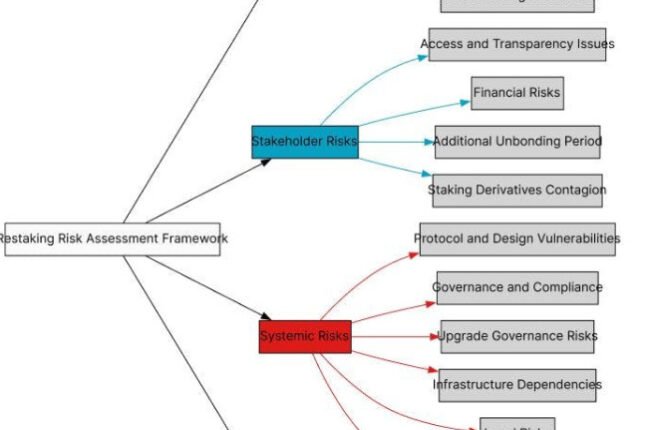

Liquid staking gained popularity in a short timeframe. It allows you to get twice the rewards compared to single staking. You single stake an asset and in turn you receive a liquid staking token (LST).…

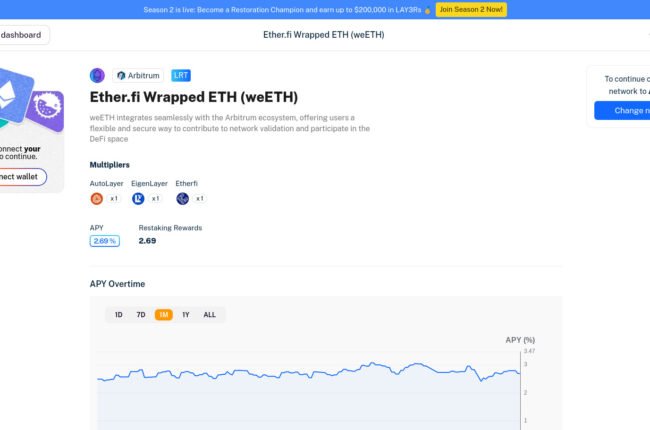

Before the summer doldrums hit every part of the market, one of the hottest topics was Ethereum restaking. Specifically, Eigenlayer and related projects. Autolayer takes advantage of integrations with Eigenlayer and also native DeFi protocols…

Top metaverse platform Bloktopia now has a weekly publication detailing important updates in its activities. The publication dubbed Developer Diaries will help carry its users along while giving them a transparent view of Bloktopia’s progress.…