Bitcoin (BTC) could go up by around 15% from the current level if demand for the flagship crypto asset remains robust and the market continues in an upward trend, according to analytics platform Glassnode.

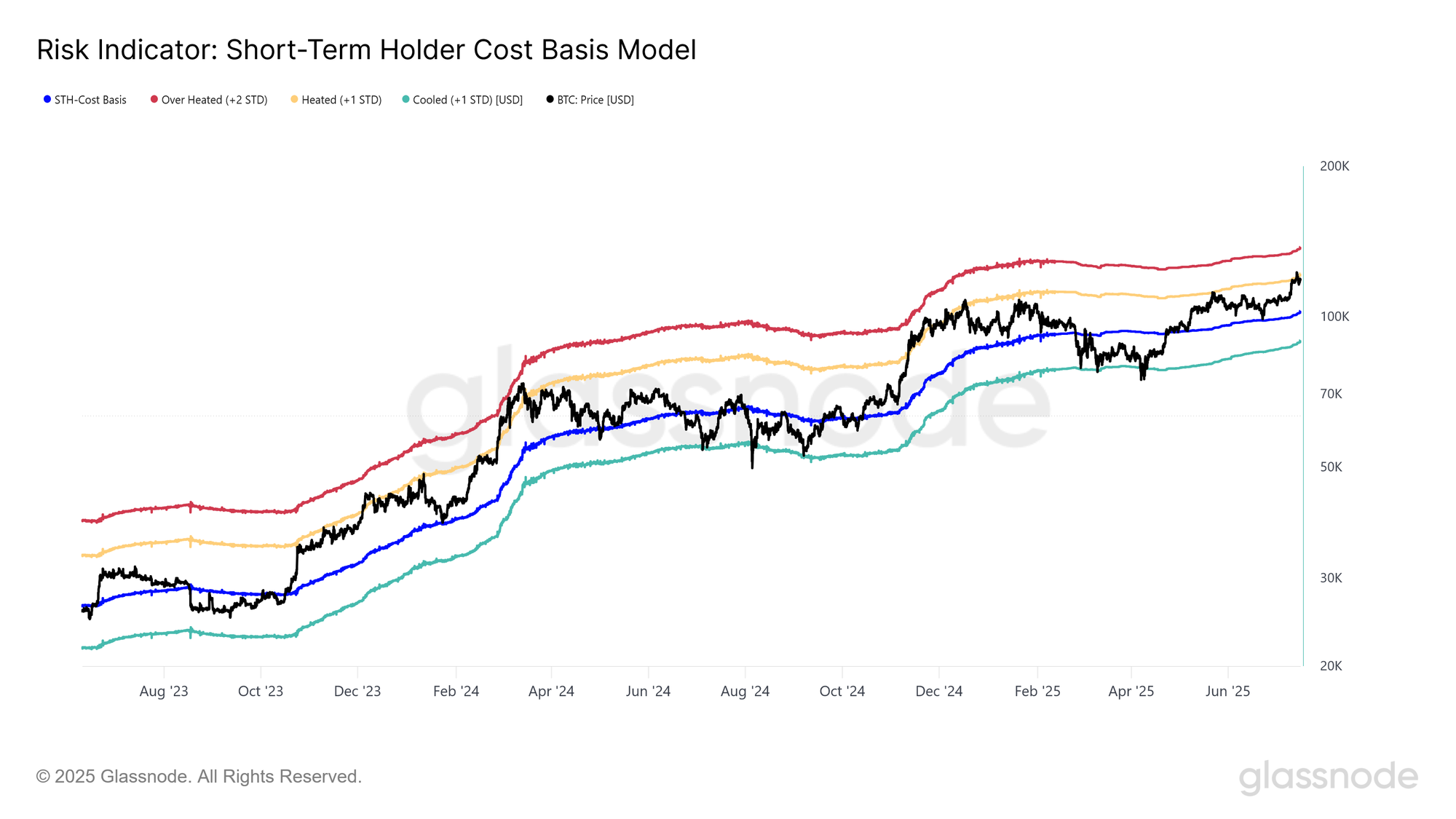

The analytics platform says that, based on the short-term holder (STH) cost basis model, the next major resistance level for the crypto king stands below $140,000.

The STH cost basis model is an on-chain metric that estimates the average price at which short-term Bitcoin holders acquired their coins. The metric can be used to spot potential entry and exit points.

“Assuming current momentum remains strong, the next key resistance lies at the +2 standard deviation band, which is currently trading around $136,000.”

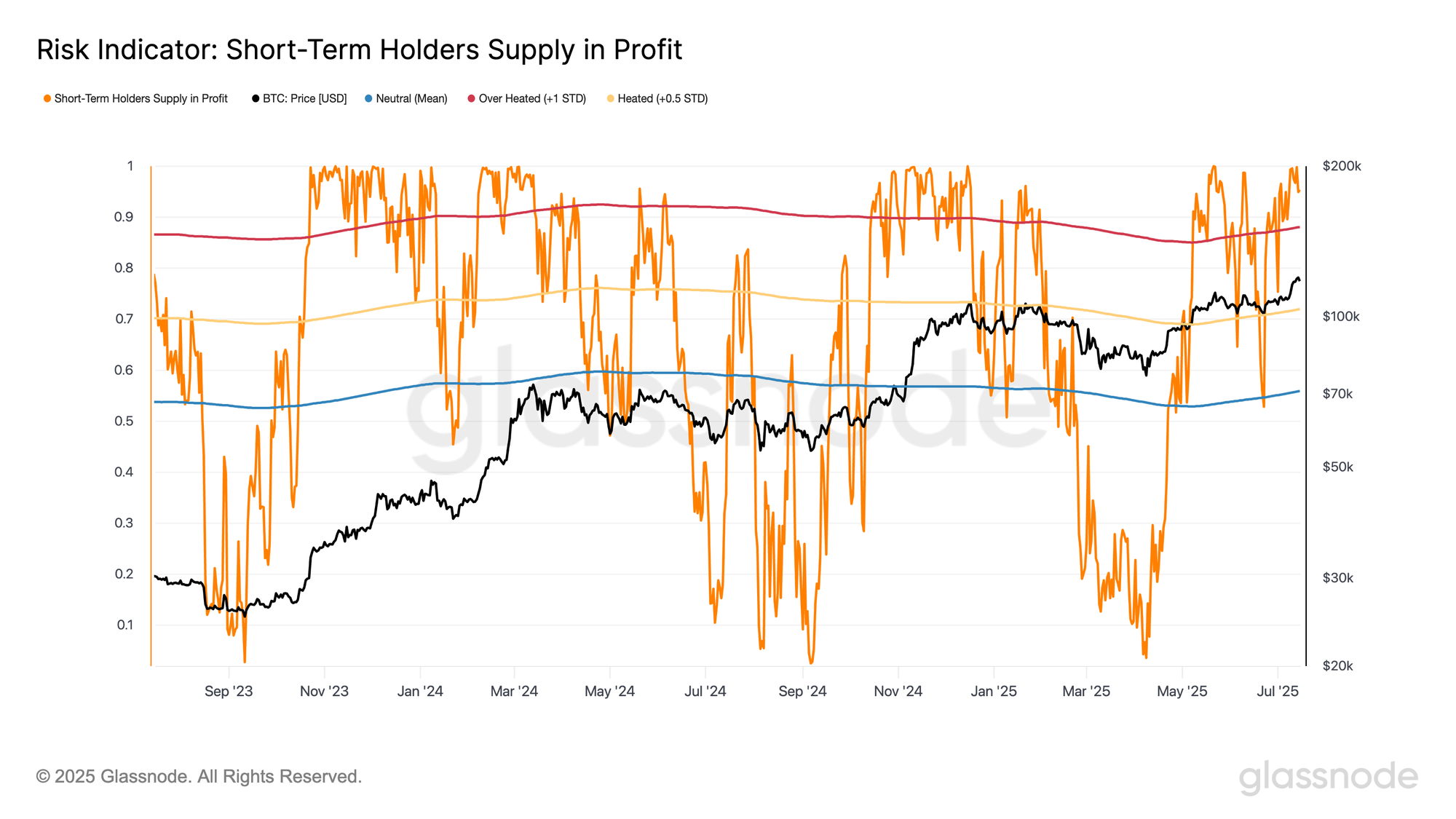

Glassnode, however, says that while there’s potential for another leg higher for Bitcoin, the flagship crypto asset could form a near-term top as short-term holders are sitting on significant unrealized profits.

“Bitcoin has broken to new [all-time highs] ATHs, and has cleared above two major accumulation zones. This represents a significant market move, which tends to be followed by strong positive momentum.

However, short-term holders, being the more price-sensitive cohort, are now seeing their unrealized profit reaching marginally overheated levels, making the incentive for them to sell and take profit increasingly likely.”

According to Glassnode, the percentage of short-term holder supply of Bitcoin in profit is currently at 95%, seven percentage points above the long-term mean of 88%.

“If this metric begins to stabilize or decline below the 88% level, it could be an early signal of weakening demand or distribution taking hold.”

Bitcoin is trading at $117,810 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin Could Explode to $136,000 if Demand Remains Resilient, Says Analytics Firm Glassnode – But There’s a Catch appeared first on The Daily Hodl.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.