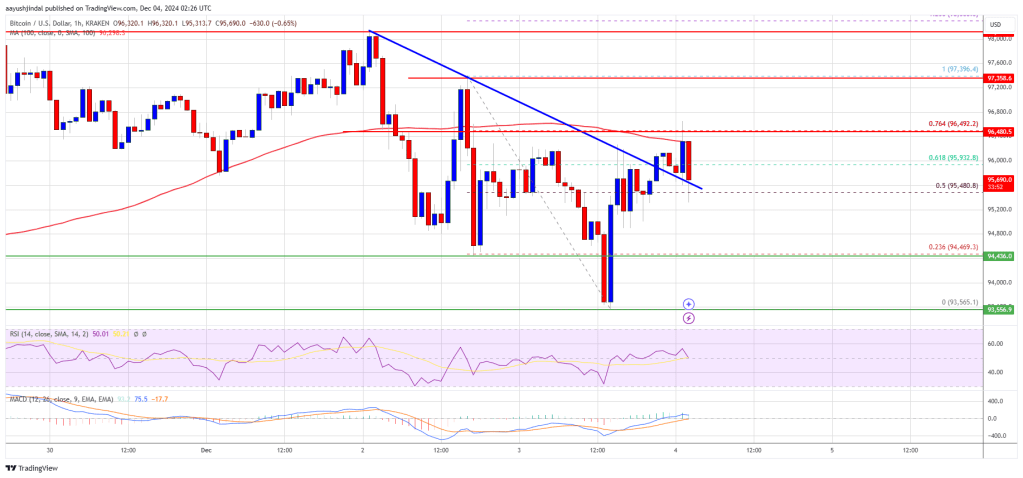

Bitcoin prices consolidate near the $95,000 level. BTC must clear the $96,500 resistance zone to attempt a fresh increase in the near term.

- Bitcoin is holding gains above the $93,500 zone.

- The price is trading below $96,500 and the 100 hourly Simple moving average.

- There was a break above a short-term bearish trend line with resistance at $96,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it clears the $96,500 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price attempted to clear the $96,500 resistance zone. However, the bears remained in action and BTC corrected lower. There was a move below the $94,500 support zone.

The price even spiked below $94,000. A low was formed at $93,565 and the price is now attempting a fresh increase. There was a decent move above the $95,000 level. The price climbed above the 50% Fib retracement level of the downward move from the $97,395 swing high to the $93,565 low.

There was a break above a short-term bearish trend line with resistance at $96,000 on the hourly chart of the BTC/USD pair. Bitcoin price is now trading below $96,500 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $96,500 level. It is close to the 76.4% Fib retracement level of the downward move from the $97,395 swing high to the $93,565 low. The first key resistance is near the $96,800 level. A clear move above the $96,800 resistance might send the price higher.

The next key resistance could be $98,000. A close above the $98,000 resistance might send the price further higher. In the stated case, the price could rise and test the $99,000 resistance level. Any more gains might send the price toward the $100,000 level.

Another Drop In BTC?

If Bitcoin fails to rise above the $96,500 resistance zone, it could start another downside correction. Immediate support on the downside is near the $95,500 level.

The first major support is near the $95,000 level. The next support is now near the $93,500 zone. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $95,500, followed by $93,500.

Major Resistance Levels – $96,500, and $98,000.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.