It’s not always roses and rainbows in the cryptocurrency market and even though it may have felt like it for the past few weeks, the last seven days made sure to remind us of it. The total capitalization dropped by more than $300 billion as Bitcoin’s price went on a complete rollercoaster, similar to that of the majority of altcoins.

The first few days of the week started as we are more or less used to by know – up only. Bitcoin’s price tapped a new all-time high above $108,000 and the market was anticipating the results of the meeting of the US Federal Result. Quite frankly, everyone was expecting for the institution to once again cut the interest rates, which is generally perceived as a positive move as far as risk-on assets go. Oh, if it were true this time around.

During the meeting, the Chairman Jerome Powell said that they might consider a slowdown of rate cuts, given that the inflation in the country is rising. This propelled a market-wide sell-off across the crypto industry but also across tradfi as the majority of indices also dropped considerably.

More interestingly, Powell addressed the possibility of Bitcoin becoming a reserve asset for the country, saying that the Federal Reserve is legally prohibited from holding it. This might put a dent into Trump’s plans and it appears that investors didn’t like it as the cryptocurrency is now trading below $100K, having plummetted to around $92,000 earlier today.

The sell-off also triggered over $1.3 billion worth of liquidated positions across the cryptocurrency market on Friday alone.

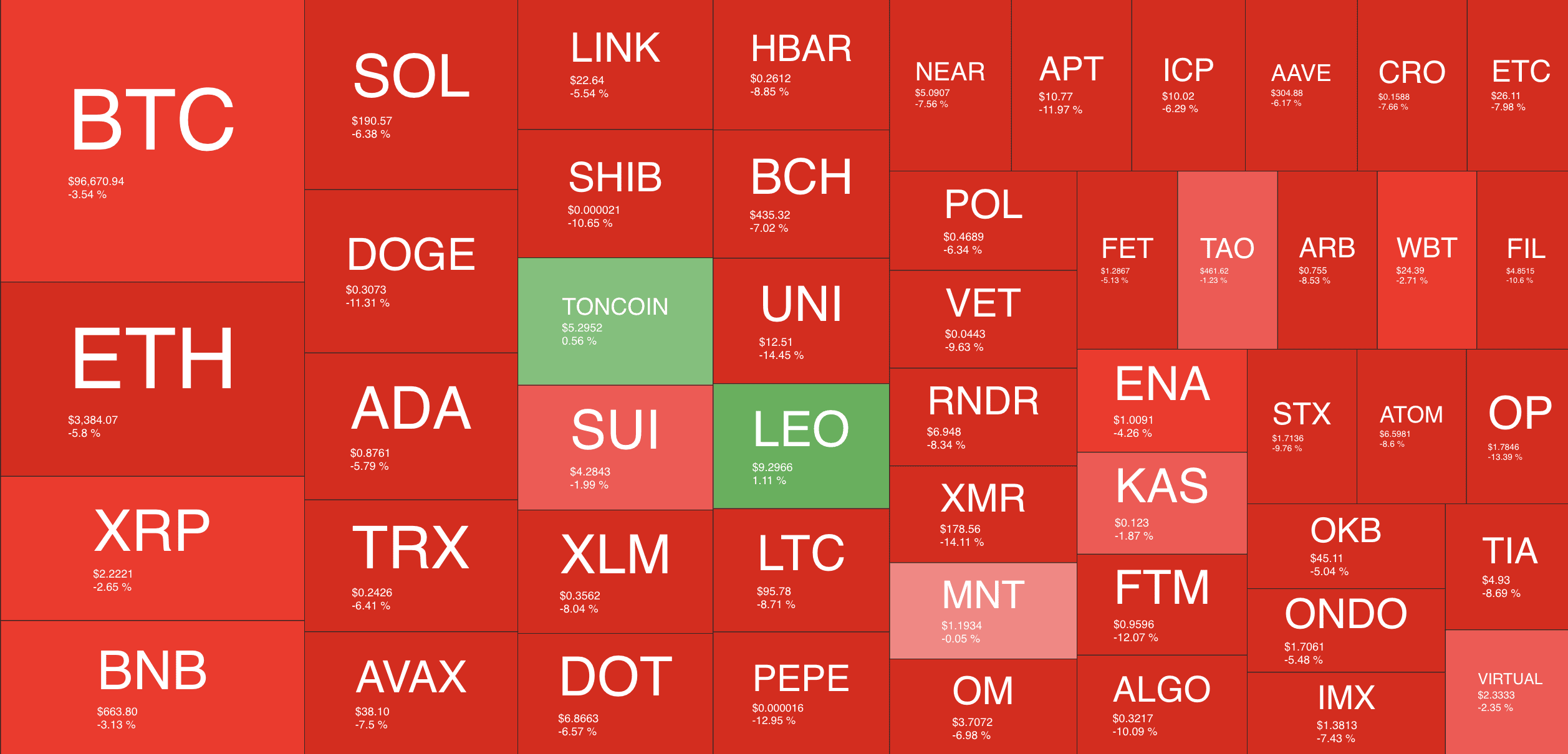

The majority of altcoins are trading in the red, with Ethereum down almost 15%, XRP – 10%, BNB – 8%, Solana -15%, DOGE – 25%, and so forth.

As it’s almost always the case, a lot of people in the community are already speculating whether or not the bull run is over, but during times like these it’s really important to zoom out and keep a steady eye on the bigger picture.

In any case, if one thing is sure, it’s that the next few weeks are likely to be quite interesting, so let’s see how it goes!

Market Data

Market Cap: $3.45T | 24H Vol: $482B | BTC Dominance: 55.3%

BTC: $96,552 (-4.5%) | ETH: $3,370 ( -15% ) | XRP: $2.21 (-10%)

This Week’s Headlines You Can’t Miss

MicroStrategy Announces First Bitcoin Purchase With BTC Prices Above $100K. It wouldn’t be a Monday these days if the Michael Saylor-founded business intelligence giant didn’t announce a massive BTC purchase. In this week’s example, the company allocated $1.5 billion to accumulate 15,350 BTC at an average price of just over $100,000.

XRP Price on the Move as Ripple Announces Stablecoin Launch on Dec 17. Although it continues with its legal tussle against the US securities watchdog, Ripple entered the stablecoin industry this week by finally launching its own product called RLUSD. The token release was on December 17, and it positively impacted XRP’s price at the time.

This Cohort of Ethereum Whales Accumulates Record 57.35% of Supply. Ethereum whales have been on an accumulation spree lately, according to on-chain data. The number of large wallets holding at least 100,000 ETH has jumped to an all-time high of over 57% of the entire supply.

BlackRock’s IBIT Nearly Doubles Gold ETF’s 20-Year AUM Milestone in Less Than 12 Months. The world’s largest Bitcoin ETF continues to shatter records. Its AUM has skyrocketed in the past 11 months to almost $60 billion as of December 19, which dwarfed the performance of the company’s biggest gold-based ETF.

Bitcoin Price Tumbles Toward $100K Despite Fed’s Latest Rate Cut. The entire financial field expected another rate cut at the end of 2024, and that’s what they got. However, the hawkish words by Jerome Powell about potentially stopping the rate reductions in 2025 sent the ever-volatile and risky crypto market down hard. At first, BTC tumbled toward $100,000 but quickly lost that level and dumped all the way south to $92,100, leading to speculations about whether this bull market has ended.

Fed Effect: Biggest Net Outflow Day for Bitcoin ETFs Led to Crash Below $96K. Powell’s aforementioned comments seemingly scared US investors out of their BTC positions, which is particularly true for the spot Bitcoin ETFs. The financial vehicles recorded their worst day in terms of daily net outflows on the day after the FOMC meeting (December 19), with nearly $700 million being withdrawn.

The post Bitcoin’s Wild Ride: From $108K to $92K (Market Update) appeared first on CryptoPotato.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.