The Ethereum (ETH) price pushed above $4,100 for the first time this year on Monday, as bullish sentiment rose following Bitcoin (BTC)’s renewed push to fresh record levels above $107,000.

Optimism that the US will establish some sort of strategic Bitcoin reserve in 2025 under the incoming Trump administration is the main talking point right now.

Of course, this is helping to lift the entire crypto market, not just Bitcoin. But Ethereum also benefits from highly bullish narratives of its own.

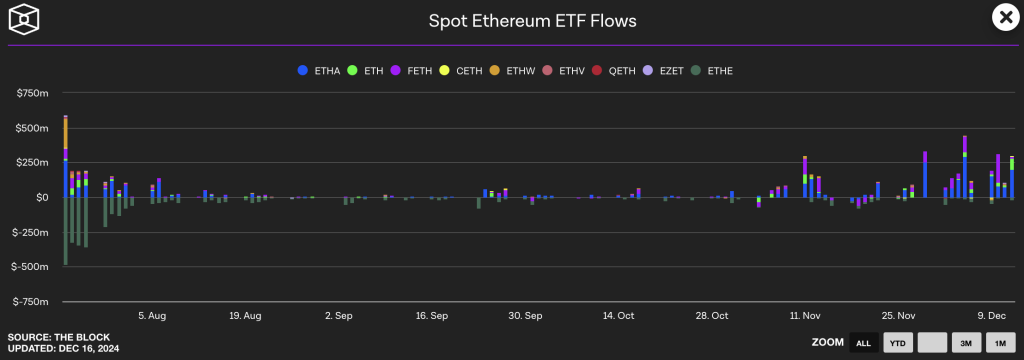

Ethereum remains the only crypto other than Bitcoin to have spot ETFs in the US. And ETH ETF volumes and inflows have been ramping up in recent weeks, per data presented by The Block.

And this is just the “tip of the iceberg”, a Blackrock executive told Bloomberg’s ETF analyst Eric Balchunas last week.

Jay Jacobs said that only a very tiny fraction of Blackrock clients currently own either their IBIT Bitcoin ETF, or their ETHA ETH ETF.

He added that Blackrock remains focused on bringing new clients to these ETFs, rather than focusing on launching new ETFs tied to other cryptos.

Blackrock is one of the most influential firms on Wall Street, so their choice to focus on their BTC and ETH could be a huge boon for Ethereum.

“Ethereum is BlackRock’s chosen alt-coins” is a narrative likely to drive a substantial upside in the Ethereum price in the coming year.

Ethereum Price – $5000 Next?

The current market environment is perfect for ETH and the world’s second-largest cryptocurrency by market cap is likely primed to hit $5,000 to print new all-time highs before the year’s end.

The Fed is set to cut interest rates later in the week, which, combined with growing optimism about the incoming Trump administration, ought to keep a bid across all major cryptos.

But historic patterns also support the idea of fresh upside in the Ethereum price.

When Bitcoin breaks into a new phase of price discovery 6-8 months on from its halving, Ethereum typically tends to la by between one to two months.

It’s not been over a month since Bitcoin broke to fresh record levels, suggesting the clock is ticking down for Ethereum’s breakout.

While a new phase of Ethereum price discovery might not come until January, a retest of all-time highs before the year’s end amid a “Santa rally” is highly likely.

Analysis of Ethernet’s short-term technical picture also looks good. Ethereum is in a short-term uptrend and probing for a lasting breakout above $4,100.

Once this level decisively breaks, its only a short jump to the 2021 record highs.

As chatters grows about a potential $200,000 BTC price later this cycle, talk will soon start rising about an ETH price of $10,000 or more.

That makes it a strong candidate for best crypto to buy now.

Better Alternative to Consider?

However, while 2.5x gains would be a thing of beauty for most investors, some in the crypto space are hunting gains of 10-20x or more.

One of the best ways to generate strong returns like this is to invest in a new meme coin with strong momentum but with a market cap still below $1 billion.

One meme coin that the team at cryptonews.com is a big fan of is a fun new gamified cat token called Catslap (SLAP).

This highly promising meme coin has already been able to reach a market cap of over $20 million per DEXTools, but if it continues to gain momentum, could soon hit $100 million.

The meme coin is running a massive $100,000 giveaway to users who accumulate the most slap points.

With a new meme season likely to hit as new Etheruem price discovery arrives, SLAP could be one of the best performing memes.

The post BlackRock Exec Predicts Massive Ethereum ETF Boom – Is $5,000 ETH Next? appeared first on Cryptonews.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.