Pendle positioned itself for the coming restaking wave. This wave is about to hit crypto big time. There’s already the LRTfi space. An LRT is a liquid restaking token. To clarify, EigenLayer (EL) is the force behind everything that’s related to restaking. EL has set up a points system. That’s where Pendle fits in.

So, we’re going to take a closer look at what role Pendle has in restaking.

Pendle and LRT Protocols

Taking part in Pendle’s strategy, sets you up for an EigenLayer airdrop. As already mentioned, EigenLayer has a points system in place for this. By using Pendle’s Yield Tokens (YT), you can make them part of your Point farming strategy. Not only for EigenLayer but also for other LRT protocols.

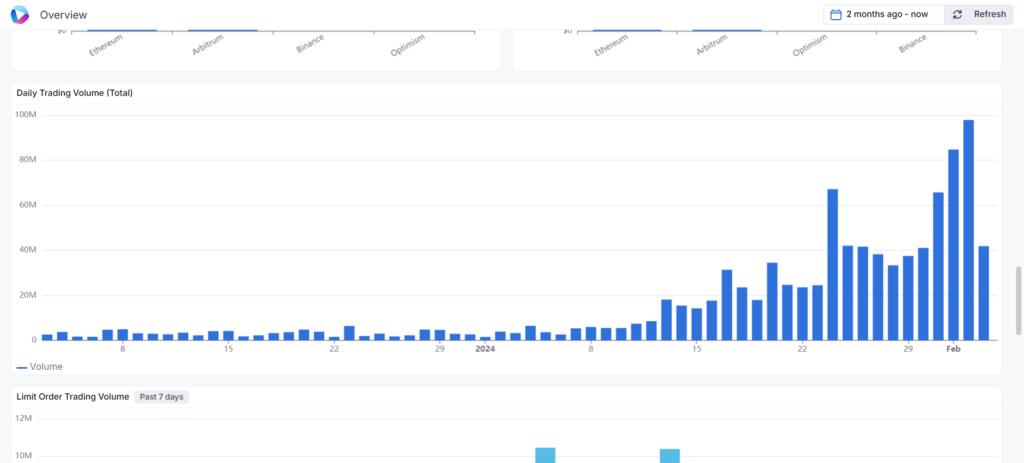

So, in that vein, one of the first things Pendle did, was to work together with ether dot fi. This is a restaking platform. You can restake their native LST (liquid staking token), eETH. This cooperation worked out well for them. It increased their TVL to $78 million in only 10 days. As a result, Pendle finds itself back on spot #22 for TVL among all Ethereum platforms. You can check their current DeFiLlama ranking here. Since mid-January, Pendle also saw an increase in daily trading volume. See the picture below.

Source: Sentio

To clarify, to get a decent airdrop, you need a big ‘Points’ allocation. That’s where Pendle comes to the rescue. You can leverage your capital to earn Points on EigenLayer and RLT protocols. Points farming is on! So, that’s what we’ll be looking at next. Let’s find out how ‘Points’ work on EigenLayer and RLT protocols.

How Do Points Work on EigenLayer and Other Liquid Restaking Token Protocols

It’s important to understand how Points work on EigenLayer and other LRT Protocols. The whole point is to get maximum use out of the Points and all related protocols. So, let’s first take a look at EigenLayer.

On EigenLayer, you can deposit LSTs like stETH or rETH and many more. Now you qualify for ‘Restaking Points’. The more you restake, and the longer, the more Points (EL Points) you earn.

The various LRT Protocols have a similar setup. However, they may call their rewards different. For example, Kelp uses ‘Kelp Miles’ or ether dot fi has ‘Loyalty Points’. See the picture below.

Source: ether.fi

Now, many people expect the EigenLayer airdrop to be the mother lode of all airdrops. This may well become the biggest airdrop in airdrop history. Nonetheless, you should play your hand smartly. So, don’t deposit straight on EigenLayer. Instead, deposit on LRT Protocols. Now you earn EL Points and the Points from the protocol that you use. The protocols will also have airdrops. This way, you secure two airdrops at the same time.

Farming Strategies Based on Your Risk Profile

Pending on your risk tolerance, you can base your strategies accordingly. There are three options to consider. At the end of the day, you want to earn EL points and Ether Points or Loyalty Points.

No risk — You swap your eETH for PT-eETH. A current APY is closing in on 34%. That’s after maturity and sounds like a sweet deal. That may be tempting as well. However, this doesn’t earn you any EL or Ether Points. You can only earn these Points with the YT token. The picture below shows this PT option.

Source: Pendle App

Low risk — You can provide LP to PT-eETH/weETH. For example, on Penpie. This is a subDAO by Magpie. Now you can farm Points with your ETH. Currently, its APY is 31.48%. Moreover, you also earn EL Points and Loyalty Points. As a bonus, there’s no IL (Impermanent Loss). The upside potential is larger compared to the no-risk option, described before. See the picture below.

Source: Penpie

High risk — This buying YT-eETH. This is like a leveraged point farming strategy. In this setup, 1 eETH gives you 9.72 YT-eETH. In other words, your rewards are as if you’re holding 9.72 eETH. Furthermore, you receive EL Points and double Loyalty Points. So, in a nutshell, you’re buying Points with this strategy. You’re also longing for yield at 34%. The APR on your eETH is only 2.7%.

If that rate remains constant, you can lose most of your capital (-99.8%) if the rates remain the same. There’s no real organic yield for your YT tokens. See the picture below.

Source: Pendle App

So, be careful how you position yourself. The high-risk option is what it says, high risk. Find the right balance for yourself.

Okay word of warning before we proceed further, we’re venturing into some guesstimation territories here with a lot of assumptions.

But your approach towards “to YT or not to YT” should be something similar.

Here’s some back of a napkin calculation: pic.twitter.com/7fhSbgW1Q4

— Pendle Intern (@PendleIntern) January 12, 2024

Conclusion

Last year, in 2023, Pendle positioned itself in the LST market. By doing so, it received a tremendous boost. So, this year, 2024, Pendle is doing the same with LRTs. Pendle will likely receive a similar boost.

Plenty of LRT protocols are keen to join Pendle. They’re looking for airdrop hunters. This will gain the platform’s massive TLVs. They can get TVL boosts for millions of USD at a time. As soon as yield-bearing tokens come into play, Pendle can play into that. That’s why it fits so well in these LST and LRT narratives.

As a result, Pendle’s own TVL should keep growing as well. The $1 billion mark should be a realistic option.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post How to Farm Yield in Pendle appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.