This 22,000% ROI is not in some memecoin. Nor, a new trend where we aren’t sure what will happen to it a year from now. Do you know who it is? It’s one of our favorite projects in RWA. And at the rate they are growing, they could become bigger than Mantra at $4 billion. So who is it? It’s Clearpool.

Today, we show you why Clearpool is growing this fast and why we expect that growth to continue well into 2025. A big reason for this growth will come from their new Ozean blockchain.

Brief Intro to Clearpool

Clearpool is the first Web3 project to bring decentralized credit to the blockchain. Now, lending is something we’ve seen before. Lots of DeFi protocols do that. But what Clearpool does is different. Traditional DeFi is overcollateralized lending. You deposit 10k to borrow 7 or 8k. That’s an inefficient use of capital.

Clearpool is doing undercollateralized lending or credit-based lending. So they are lending based on project strength and the ability to pay back. That’s like lending in the legacy Web2 world. It doesn’t take much to see that if Clearpool does this successfully, then they will be ENORMOUS as a result. They’ve already originated $650 million in loans. And they are still just starting.

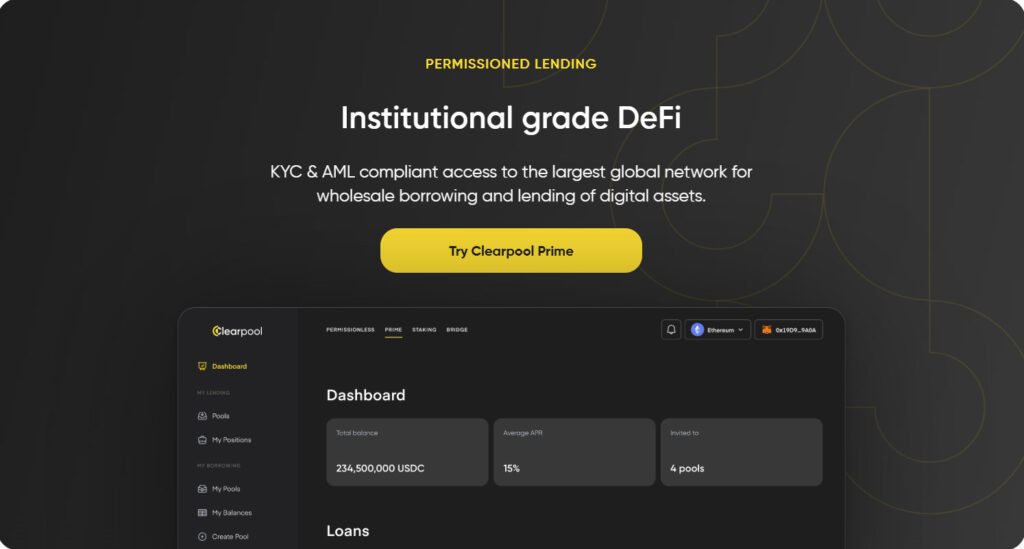

Institutional-grade borrowers go through KYC, AML, and credit checks. Once complete, they can decide to borrow via one of Clearpool’s three products — Dynamic Pools, Credit Vaults or Clearpool Prime.

Source: Clearpool website

Soon, we will have another video on how their underwriting works to bring in loan volume but protect lenders’ capital. It’s easy to see why I said at the top, Clearpool could surpass Mantra just on this alone. If it gets undercollateralized lending right, then it will be huge. But, their even bigger innovation is Ozean.

The highly anticipated launch of Ozean moves one step closer…

Ozean’s Poseidon Testnet is LIVE!

This milestone brings us closer to enabling automatic native yield on-chain through Ozean’s RWA-focused blockchain, paving the way to unlock trillions in TradFi capital.

— Clearpool (launching Ozean

) (@ClearpoolFin) December 12, 2024

What Is Ozean?

Ozean is Clearpool’s regulatory-compliant Layer 2 chain for RWA projects, where you can earn native yield. I know that’s a mouthful. The compliance part is important for RWA projects and protocols. Institutions and TradFi are not going to come over to our side and tokenize or lend or borrow on-chain if they will get in trouble with regulators at home.

They just won’t. They have other options that are compliant, they can use. So it has to be compliant. It also has to be easy to use.

Ozean is an Ethereum Layer 2 built on Optimism. It’s part of the Optimism Superchain, which is a group of chains with compatible services and shared security. Ozean is sharing with chains like Base, Optimism, Uniswap’s Unichain, and more.

Ozean’s unified compliance layer is a big innovation for RWA protocols. Here, a project can set its preferences based on their regulators between

- Retail, that’s anyone

- Wealthy individuals like accredited investors in the US

- and/or institutions.

For example, a TradFi firm may come here for capital, but only other institutions can lend to them. They can easily set that preference to exclude you and me but include other institutions. Ozean offers some other benefits too. Benefits for everyone, including retail investors.

Hex Trust

One of those benefits is 2 different stablecoins. The first is USDX which is Ozean’s gas token and native stablecoin. USDX is a 1:1 stablecoin issued by Hex Trust. Hex Trust is one of the industry’s biggest custodians, that’s fully licensed across Asia, The Middle East and Europe, has over $5 billion in assets under custody attained and over 270 institutional clients including banks, exchanges, investment funds, family offices, and corporations.

Tune in at 10am UTC / 6pm HKT on Monday 16 December to listen to Clearpool’s @GirishBudhrani_ and Hex Trust’s @onchainpanini discuss migrating billions of TradFi capital on-chain

https://t.co/9GYhtjUoSb

— Hex Trust (@Hex_Trust) December 16, 2024

Clearpool has partnered with Hex Trust to jointly launch Ozean, and will bring their regulated infrastructure, services and geographic support to the Ozean blockchain.

USDX has a good chance to be a viable alternative to USDT and USDC. Clearpool’s team is behind Ozean. And if you stake the native $CPOOL token you get some amazing benefits including a piece of the revenue that USDX generates. Imagine owning a piece of Tether. Pretty cool stuff. And Hex Trust is going to make it run.

The 2nd stablecoin is ozUSD. It has 2 major differences to a typical stablecoin.

- It’s yield-bearing automatically. That’s pretty cool.

- It’s a rebase coin so it can end up with a fluctuating supply including burns every so often to maintain the price.

TradFi-ers will like this a lot, as the yield-bearing nature of this stablecoin is like putting your spare cash in a money market fund for them. They get what that is and how it works.

The Ozean Native Wallet

Another benefit that will help bring TradFi into the platform is its native wallet. The Ozean Wallet IS custodial. So that’s important to note. But TradFi isn’t going to care. In fact, they will prefer it as they know Hex Trust, and it enables them to include more sophisticated financial instruments in the wallet and not only crypto. So a TradFi can keep Web2 legacy and Web3 assets all in the same place. That’s a big deal for gaining adoption.

How Do You Use Ozean?

So I know the idea of permissioned chains kind of sucks in our industry. But we also know that this happens in RWA because dealing with regulation is such a big deal for TradFi if they want to bring their assets on-chain.

The Clearpool Protocol hits $111M in Total Value Locked!

TVL on the chain is increasing across the multiple products on the protocol – Dynamic Pools, Credit Vaults, Prime and Clearpool Oracles.

The waves are rising as Ozean’s launch gets closer…

$CPOOL pic.twitter.com/zkgZCXqLy7

— Clearpool (launching Ozean

) (@ClearpoolFin) December 13, 2024

The good news is that there are still many parts of Ozean that anyone can use without restriction. The compliance layer is an opt-in. So you don’t have to do it.

How to Use Ozean

Then how do you use Ozean? You can join the waitlist now for the mainnet and the Testnet has just gone live. The easiest way is to start by,

1 Bridging your stablecoins over to Ozean

Yes, you can start with stablecoins you already have, like USDT and USDC and bridge them over. They automatically convert 1:1 into USDX.

2 Convert USDX to ozUSD

This makes you eligible to earn yield right away. And anyone can do this, not just who the RWA issuer decides.

3 Pick Yield Duration

So this does involve locking up your coins. But as with all yield related protocols, the longer your lockup, the higher APR you earn.

4 Start Earning

Then you start earning. Plus, by having USDX already from the bridge, you have the native gas token Ozean uses if you decide to invest in one of the eligible listed RWA projects.

As you can see, it’s easy to get started once you’re off the wait list. And you can also see why we are so excited about what Ozean offers and brings to Clearpool. It feels like we are getting 2 built out projects for the price of one. We expect Ozean to unlock A TON of value for Clearpool.

The Ozean ecosystem is rapidly expanding with recent partnership and integration announcements with LayerZero, Velodrome, Ethena, Solv Protocol, Agora, and many others. Go to Ozean now and get yourself on the waitlist to try out this platform.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Clearpool.

Copyright Altcoin Buzz Pte Ltd.

The post In RWA, Can Clearpool Be Bigger Than Mantra OM? appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.

…

…