Before the summer doldrums hit every part of the market, one of the hottest topics was Ethereum restaking. Specifically, Eigenlayer and related projects. Autolayer takes advantage of integrations with Eigenlayer and also native DeFi protocols like Uniswap to be the leading marketplace for Ethereum restaking.

Let’s see what Autolayer is about, especially since their token is launching.

Intro to Autolayer

Autolayer describes itself as the leading liquid restaking token market on Arbitrum. The protocol lets you see and take part in many different LRT (liquid restaking token) options all in one place and with one click.

The idea is to bring the best options for restaking and the best in DeFi all together. Autolayer helps you manage your points for the restaking programs that have them and the 1-click marketplace can’t be beat.

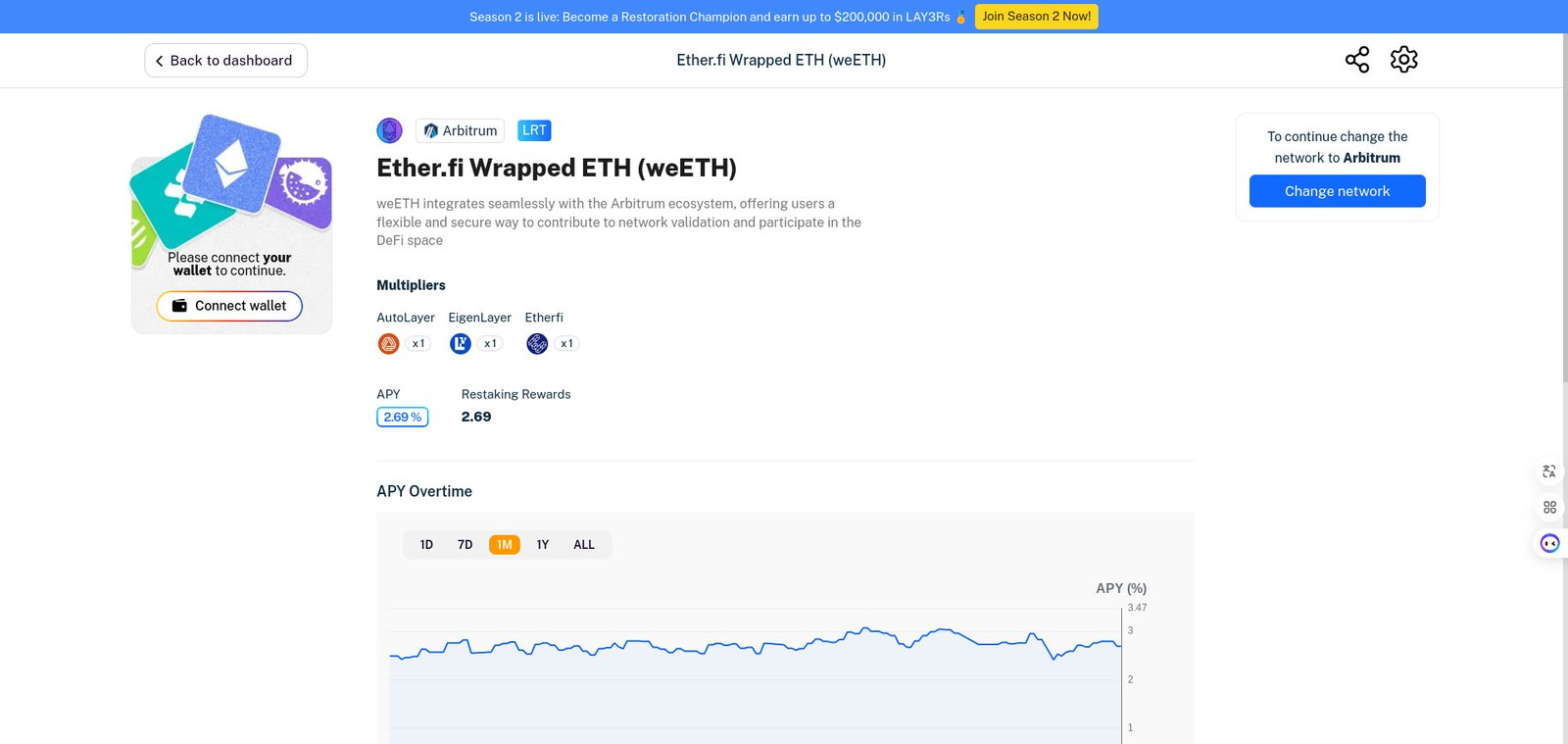

Here is a good visual below that shows you what Autolayer is all about.

Courtesy of Autolayer

You can see here that this is for Ether.fi wrapped ETH and is offering a 2.69% APY. With that you can see what points you would get and if there is a multiplier here as an added incentive to restake here. In this case, there isn’t one. And this one is on Arbitrum. But there are other choices too. For example, if you like using Ether.fi and want some weETH you can get it on Ethereum or BNB Chain, too. There are lots of choices here.

Some Initial Stats on Autolayer

The protocol is proving popular with fans of restaking. Thanks to some Dune Analytics users’ legwork, we can show you some good stats on Autolayer’s performance. They include:

TVL – $54.8 million

Total Users – 96,380

Total Volume – $242 million

Total Transactions – 396k

That’s some good adoption so far for a newer platform. You can check out all the stats here on Dune.

Some of the DeFi strategies are cool too. On Balancer, you can earn 4.45% on a combination of Ankr Staked ETH ankrETH and Wrapped Lido Staked ETH wstETH. And other than the counterparty risk of the stakers themselves, there is little to no reason why you should get impermanent loss here. After all, both have staked ETH as the underlying asset.

Because Autolayer has integrations with Eigenlayer, Ether.fi, Renzo, and more, it has the most complete set of liquid staking options on the market today.

The $LAY3R IDO

Autolayer’s native token $LAY3R has its IDO going on now. So if you like what you’ve heard so far, then you can get in from the very start. The IDO is on the following platforms:

ChainGPT

Poolz Finance

Magic Launchpad. All 3 of these platforms are sold out of their allocations.

Dexcheck Pad

GainsPad

And our friends at Seedify.

These last 3 still have some allocation left with IDO starting on the 1st or 2nd of October. Their major exchange launch is happening on Kucoin on the 3rd.

If you are into restaking, then you need to check out Autolayer.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Introduction to Autolayer appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.