Ondo Finance has faced significant challenges in recent weeks, with its price dropping over 30% from its all-time high of $2.14. Despite the recent downturn, many analysts remain optimistic about ONDO’s potential for recovery, citing its strong performance earlier this cycle as evidence of its resilience. As one of the top-performing altcoins, ONDO has consistently attracted investor attention, leading to speculation about its next move.

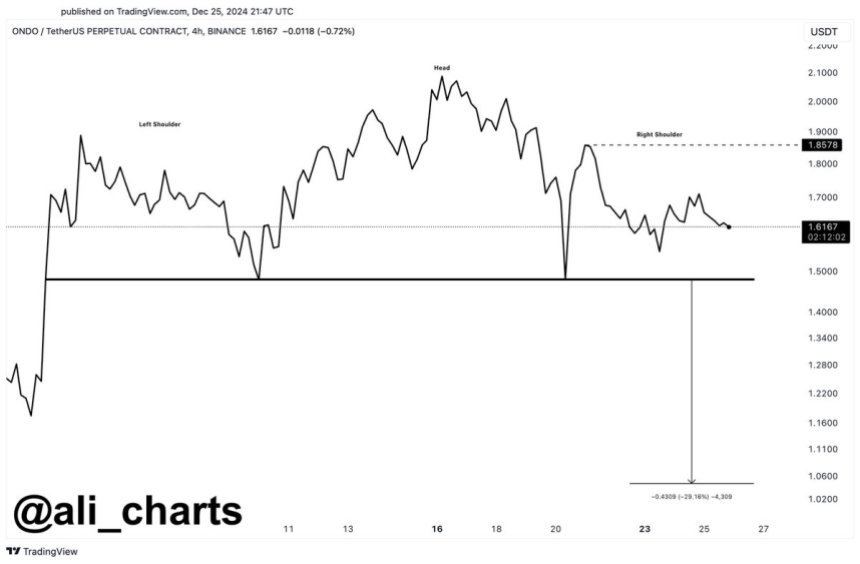

However, caution is warranted. Renowned analyst Ali Martinez recently shared a technical analysis warning that ONDO may be at risk of further correction. Martinez highlights the potential formation of a head-and-shoulders pattern on the price chart, a bearish signal often associated with trend reversals. If this pattern plays out, it could lead to increased selling pressure and a deeper pullback.

The coming days will be critical for Ondo Finance as it navigates this pivotal moment. Investors will closely watch whether the token can defy bearish signals and reignite bullish momentum or if the feared pattern will confirm, leading to additional declines. For now, ONDO’s future hangs in the balance, with market sentiment and technical indicators offering conflicting signals about its short-term trajectory.

ONDO Testing Crucial Demand

Ondo Finance has faced a significant correction after its strong rally earlier in the cycle, now testing crucial demand levels at key price points. The token’s price halted at its previous all-time high, around $1.50, which now serves as a pivotal support level. If It holds above this mark, bullish momentum could return, potentially setting the stage for a renewed uptrend.

However, top analyst Ali Martinez has raised concerns with a technical analysis that suggests ONDO may be forming a bearish head-and-shoulders pattern. This pattern, if confirmed, typically signals a trend reversal and could lead to increased selling pressure.

Martinez warns that a decisive close below the $1.48 level could trigger a steep 30% correction, driving ONDO’s price down to approximately $1.05. Such a move would represent a significant setback for the token and its investors.

To invalidate this bearish scenario, ONDO must reclaim the $1.86 level as support, a move that would signal strength and restore confidence in the asset’s bullish potential. Until then, the market remains at a critical juncture, with traders closely monitoring price action for clues about ONDO’s next direction. The coming days will be decisive in determining whether ONDO can recover or faces further downside risk.

Technical Analysis: What To Expect

Ondo Finance (ONDO) is currently trading at $1.49 after successfully testing the critical $1.46 support level highlighted by top analyst Ali Martinez. This level has proven to be a significant line of defense for ONDO, reflecting strong buying interest at this price. The token appears stable for now, but market participants remain cautious, as broader market conditions could still impact ONDO’s trajectory.

The recent resilience at $1.46 is encouraging, suggesting that ONDO may be building a foundation for a potential recovery. However, a market-wide retrace could put additional pressure on ONDO, possibly driving its price lower and retesting critical demand levels. Investors are keeping a close eye on key technical levels for confirmation of a bullish rebound.

For ONDO to regain upward momentum, reclaiming the $1.70 level in the coming days is essential. A decisive move above this mark would signal renewed strength, paving the way for a bullish recovery and potentially retesting previous highs. Until then, ONDO remains in a delicate position, with traders monitoring broader market sentiment and the asset’s ability to sustain current support levels. The next steps will be crucial in determining whether ONDO can resume its uptrend or face continued consolidation.

Featured image from Dall-E, chart from TradingView

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.