Donald Trump’s economic playbook is chaos wrapped in contradiction. His decisions seem to thrive on unpredictability, leaving financial markets and global policymakers scrambling to make sense of them.

Hedge funds, economists, and even his own advisers are left guessing as Trump’s policies oscillate between wild promises and actions that undercut them.

Bridgewater recently warned its clients that Trump plans to “go big” in reshaping U.S. institutions, global trade, and foreign policy.

Yet, they openly admitted their predictions are little more than educated guesses due to the lack of clarity around his plans. Investors are left to hedge their bets, bracing for whatever may come.

Inflation and tariffs: A self-made dilemma

One of the clearest contradictions in Trump’s policies is his stance on inflation and tariffs. During his campaign, he slammed the Biden administration for soaring inflation, promising to bring it under control.

But his proposed 60% tariffs on Chinese imports and 25% tariffs on goods from Mexico and Canada could have the opposite effect. Treasury Secretary Janet Yellen has warned that the tariffs will “derail” the fight against inflation.

Stephen Moore, one of Trump’s economic advisers, dismissed this concern, claiming there was no inflation spike during Trump’s first term despite higher tariffs. However, inflation is now at 2.7%, already above the Federal Reserve’s target.

Goldman Sachs estimates Trump’s tariff plans could add another percentage point to inflation—before factoring in labor cost increases from mass deportations.

The Federal Reserve and interest rate chaos

Trump’s relationship with Federal Reserve Chair Jerome Powell has been anything but smooth. While Trump recently pledged to keep Powell in his role, history suggests otherwise. He has repeatedly criticized Powell, even calling him an “idiot,” and pressured the Fed to lower interest rates during his first term.

The stakes are higher now. Debt-servicing costs have surged, giving Trump more incentive to push for rate cuts. But Powell has consistently defended the Fed’s independence, leaving a potential standoff on the horizon.

Trump’s team has flagged the U.S. dollar as overvalued, with Scott Bessent, his Treasury Secretary nominee, suggesting the need for a “grand global economic reordering” akin to the Bretton Woods agreement. Bessent even hinted at convening a G20 meeting to replicate the 1985 Plaza Accord.

Bessent has admitted that two-thirds of tariff impacts typically manifest as currency gains, which would strengthen the dollar rather than weaken it. Most economists agree this scenario is likely, creating a paradox where Trump’s policies could work against his own goals.

Trump’s approach to the trade deficit defies conventional economic wisdom. He plans to slash the deficit through political and commercial dominance.

But the numbers tell a different story. During Trump’s first presidency, the U.S. trade deficit hit its highest level since 2008, rising from $481 billion to $679 billion.

Tariffs and a stronger dollar could exacerbate this issue, increasing imports instead of reducing them, especially if economic growth picks up.

In just four years, U.S. debt has shot up by $11 trillion—that’s 40% of the country’s entire GDP. To put it in perspective, it took the U.S. 220 years to rack up its first $11 trillion in debt.

The BRICS challenge

Trump’s threats against the BRICS nations are another example of his shoot-from-the-hip diplomacy. Last month, he warned of sanctions if these countries pursued a shared currency to challenge the dollar. While the BRICS have no concrete plans for such a currency, Trump’s aggressive stance could backfire.

While the dollar’s dominance is unlikely to wane anytime soon, Trump’s unpredictable use of U.S. power could accelerate the search for alternatives. Ironically, the very actions meant to protect the dollar could end up undermining it. How does Trump not see that?

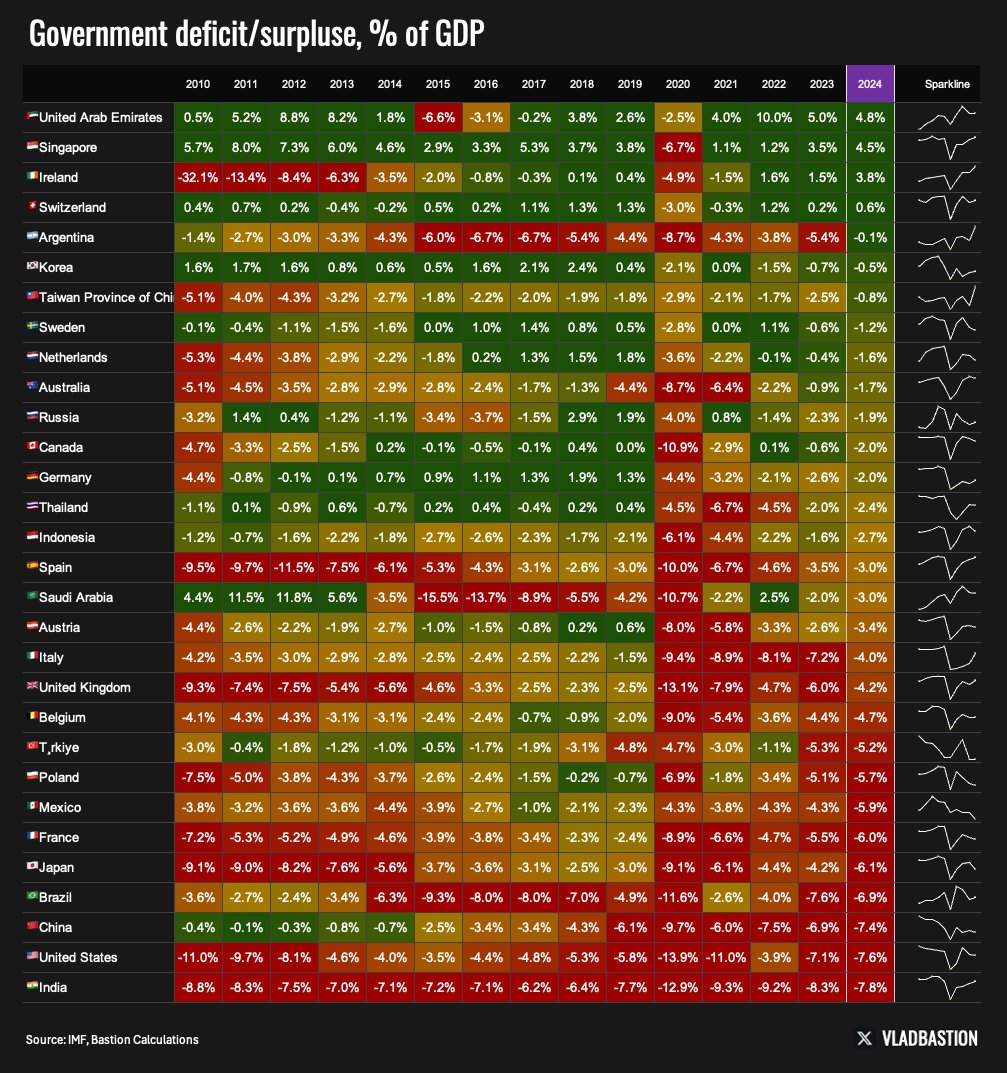

The president’s fiscal plans are another quagmire of contradictions. He has vowed to cut the federal deficit from 6.5% to 3% of GDP while simultaneously promising massive tax cuts. His team claims this gap will be filled by economic growth, government spending cuts, and tariff revenues.

But analysts are skeptical. Even if some fiscal improvements occur, the scale of Trump’s promises seems unrealistic.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.