In Web3, one avenue for generating income involves selling crypto investments when the market prices surge. Another way is through staking, where you can leverage your digital assets to generate passive income without selling. But how to enable quick unstaking?

So, it’s no surprise that staking is a frequently discussed concept among crypto investors. However, it typically involves a mandatory lock-up period during which asset withdrawal is restricted. But what if you need to access the funds immediately? Don’t worry; we’ll explain this here.

Economics Of Staking

Before delving into the topic, let’s briefly explore the concept of staking. Staking entails locking crypto assets for a specific duration to support blockchain operations, commonly applied in proof-of-stake (PoS) consensus mechanisms. In exchange for staking your crypto, you receive additional cryptocurrency.

Essentially, participants engage in staking to validate transactions and contribute to block creation, ensuring the inclusion of only legitimate data. Successful validations lead to rewards, while improper actions may result in penalties, including losing the staked amount.

Many people make 7 figs on staking, don’t miss out!

I’ve prepared a guide on how to stake $ATOM & $TIA & $OSMO and $DYDX

Time: 20 minutes

Potential gain: $10,000+

Follow my to change your live pic.twitter.com/UlGs4NFPEY

— Gargoyle (@degargoyle) January 29, 2024

However, staking has risks, such as the inability to cash out or trade tokens during the commitment period:

Moreover, liquid staking products, like those from Lido Finance and Rocket Pool, offer some flexibility. But, there’s no guarantee of finding buyers or recovering investments early.

Furthermore, the unpredictable nature of cryptocurrencies introduces risks, as staked tokens may lose value during market downturns.

Validators may also face “slashing” penalties, impacting the staked amount on the network.

Now, shifting the focus to the technical side, bonding involves informing the network of your intention to stake tokens. The bonding period represents the duration during which the blockchain delegator awaits the bonding of their asset. On the other hand, unbonding is informing the network of your desire to unlock tokens.

So, the unbonding period is the timeframe for a blockchain delegator to wait before gaining access to move or sell their tokens. This period typically ranges from a few days to a few weeks or months. Notably, staked assets do not accrue rewards during the bonding and unbonding periods. Consequently, during the unbonding period, the coins remain locked on the blockchain, and their owner cannot utilize them in any transaction or earn additional staking rewards.

But Can You Bypass The Unbonding Period?

With Stride, you can bypass the unbonding period of supported tokens. But what exactly is Stride?

Stride is a blockchain (“zone”) designed to offer liquidity for staked assets. Through Stride’s liquid staking, users can earn staking rewards from Cosmos proof-of-stake tokens without staking them. By keeping the tokens liquid, users can actively deploy them in DeFi, eliminating the need to choose between staking and DeFi yields.

1/5 Announcing Stride’s first new LST of 2024 – stDYDX

Say goodbye to the 30 day unbonding period of DYDX. Now, you can be fully liquid while still earning staking rewards.

Notably, stDYDX auto-converts USDC staking rewards to staked DYDX.

Details pic.twitter.com/pAIygzevoG

— Stride (@stride_zone) January 29, 2024

The native governance token for Stride, Stride Token ($STRD), empowers holders to participate in crucial decision-making processes. It includes voting on matters like allocating staked tokens to individual validators, incorporating new validators, and various protocol enhancements. Additionally, Stride Token holders can stake their tokens, contributing to the security of the Stride Appchain.

Presently, Stride supports liquid staking for various tokens, including Cosmos Hub (stATOM), Osmosis (stOSMO), Injective (stINJ), Stargaze (stSTARS), Evmos (stEVMOS), Terra 2 (stLUNA), Umee (stUMEE), Juno (stJUNO), Comdex (stCMDX), and Sommelier (stSOMM).

Besides, Stride has ambitious plans to broaden its presence within the Cosmos ecosystem significantly. Over the next 12 months, the platform aims to onboard additional chains and tokens, including dYdX (stDYDX), Celestia (stTIA), Agoric (stBLD), Axelar (stAXL), Akash (stAKT), and more.

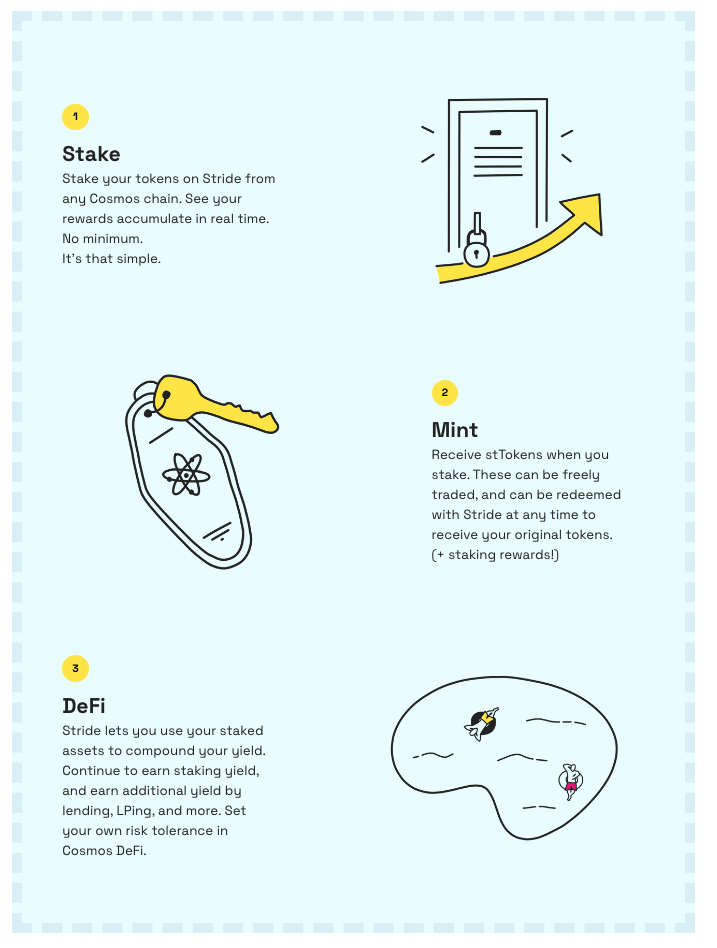

How Does Stride Work?

Utilizing Stride, you can stake various tokens (ATOM, OSMO, JUNO, LUNA, EVMOS, STARS, INJ, UMEE, CMDX, IBCX) in exchange for stTOKENs, which are deployable across the Cosmos ecosystem. stTOKENs are Stride’s Liquid Staking Tokens (LSTs). To initiate liquid staking for your tokens, visit stride.zone and choose the “Start liquid staking” option.

The primary functionality of stTokens lies in their transferability and sale, eliminating the need to endure a prolonged unstaking period or forgo staking rewards. Beyond this fundamental utility, stTokens offer additional utility in DeFi.

Source: Stride

Presently, stATOM can serve as liquidity in the ATOM/stATOM pool on Osmosis and can be lent and borrowed on Umee and Carbon Nitron. Future integrations are anticipated, with stTokens potentially appearing on other Cosmos DEXes, gaining approval as collateral for additional money markets and Cosmos CDP-backed stablecoins. Let’s look at an example:

To engage in liquid staking with ATOM using Stride, users need to lock their ATOM within the Stride Zone. In the background, Stride stakes this ATOM on their behalf, and in return, users receive stATOM. Unlike staked ATOM, stATOM is liquid, enabling users to sell, transfer, or utilize these tokens in DeFi.

More importantly, stATOM is non-inflationary, meaning its value increases as rewards compound on the original ATOM. At any point, users can redeem their stATOM for ATOM, receiving more than their initial deposit due to accrued staking rewards.

Liquid Staking Module: A Game Changer?

The Stride protocol holds a robust position in the liquid staking landscape, primarily owing to its close alignment with Cosmos chains. Beyond its association with major Cosmos chains, Stride’s LSTs have gained substantial traction on prominent Cosmos DeFi applications. Notably, Stride LSTs, particularly stATOM, constitute the predominant form of collateral currently employed to secure various forms of debt within the Cosmos ecosystem.

Stride and Celestia are kindred spirits.

They’re both blockchains optimized for a single purpose.

With Stride, it’s liquid staking. With Celestia – data availability.

“Do one thing, and do it well.”

— Stride (@stride_zone) January 25, 2024

In September 2023, the Cosmos Hub introduced its Liquid Staking Module feature (LSM), facilitating the instant liquid staking of staked ATOM. Stride protocol seamlessly integrated with the Hub’s LSM upon its launch, garnering over 90% of liquid-staked ATOM originating from the LSM.

Stride’s pivotal support for the Hub’s LSM positions the Stride protocol as a critical utility for the Cosmos Hub. Ongoing initiatives aim to extend the LSM to other chains, a move anticipated to enhance the user experience of liquid staking and foster increased adoption.

A noteworthy development in Stride protocol’s liquid staking is the growing utilization of LSTs as collateral for perpetual futures DEXes. Typically, stablecoins collateralize perpetual futures, but Stride’s stATOM, starting with Levana on Osmosis, is being employed to collateralize perpetual futures.

Given the expanding landscape of DeFi and the substantial capital requirements for collateralization, leveraging LSTs as collateral opens up a significant avenue for growth.

Unlocking $ATOM Without Waiting: Steps to Bypass the 21-Day Unbonding Period.

Step 1: Navigate to https://app.stride.zone and connect your wallet.

Step 2: Toggle the option “Pull from natively staked balance” to utilize your staked ATOM.

Step 3: Select a validator and specify the amount of ATOM you wish to liquid stake.

Step 4: Complete the liquid staking process as usual.

That’s it! You’ve now acquired stATOM.

The unstaking process on Stride involves a mandatory unbonding period before you can withdraw your tokens. The Stride blockchain initiates unbonding by consolidating the records of all unbondings on the chain. Grouping unbondings is a security measure implemented across the Cosmos ecosystem, as Cosmos chains restrict more than seven unbondings within 21 days. While this doesn’t significantly impact the average user, Stride processes requests every four days due to this constraint.

If waiting is not an option, you can sell stATOM directly on an exchange like Osmosis. The value of 1 stATOM, when redeemed through the Stride protocol redemption rate, increases predictably as staking rewards accumulate.

The market price of 1 stATOM on exchanges fluctuates based on supply and demand. Currently, the Protocol redemption rate is 1 stATOM = 1.295 ATOM, while the Osmosis market rate is 1 stATOM = 1.283 ATOM.

Conclusion

Launched in September 2022, the Stride protocol emerged amid a bear market, navigating challenges throughout its existence. Despite the adversities, this environment compelled the protocol to forge genuine utility, tangible rewards, and a robust community.

Moreover, Stride’s prominent role as the primary liquid staking provider for ATOM, INJ, OSMO, JUNO, and EVMOS positions it favorably for continued benefits amid the growing adoption of liquid staking. Besides, the inclusion of major Cosmos tokens like DYDX, TIA, and others presents substantial opportunities for immediate expansion.

A notable feature of Stride is its facilitation of prompt access to funds even while staked. While currently supporting only $ATOM, the protocol plans to include additional tokens soon. Stay tuned for more useful guides!

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Quick Unstaking Guide: Bypassing Bonding Period appeared first on Altcoin Buzz.

This articles is written by : Fady Askharoun Samy Askharoun

All Rights Reserved to Amznusa www.amznusa.com

Why Amznusa?

AMZNUSA is a dynamic website that focuses on three primary categories: Technology, e-commerce and cryptocurrency news. It provides users with the latest updates and insights into online retail trends and the rapidly evolving world of digital currencies, helping visitors stay informed about both markets.