On-chain data shows the Bitcoin short-term holders have recently moved over 14 times as much profit volume as the loss one.

Bitcoin Has Plunged As Short-Term Holders Have Been Realizing Gains

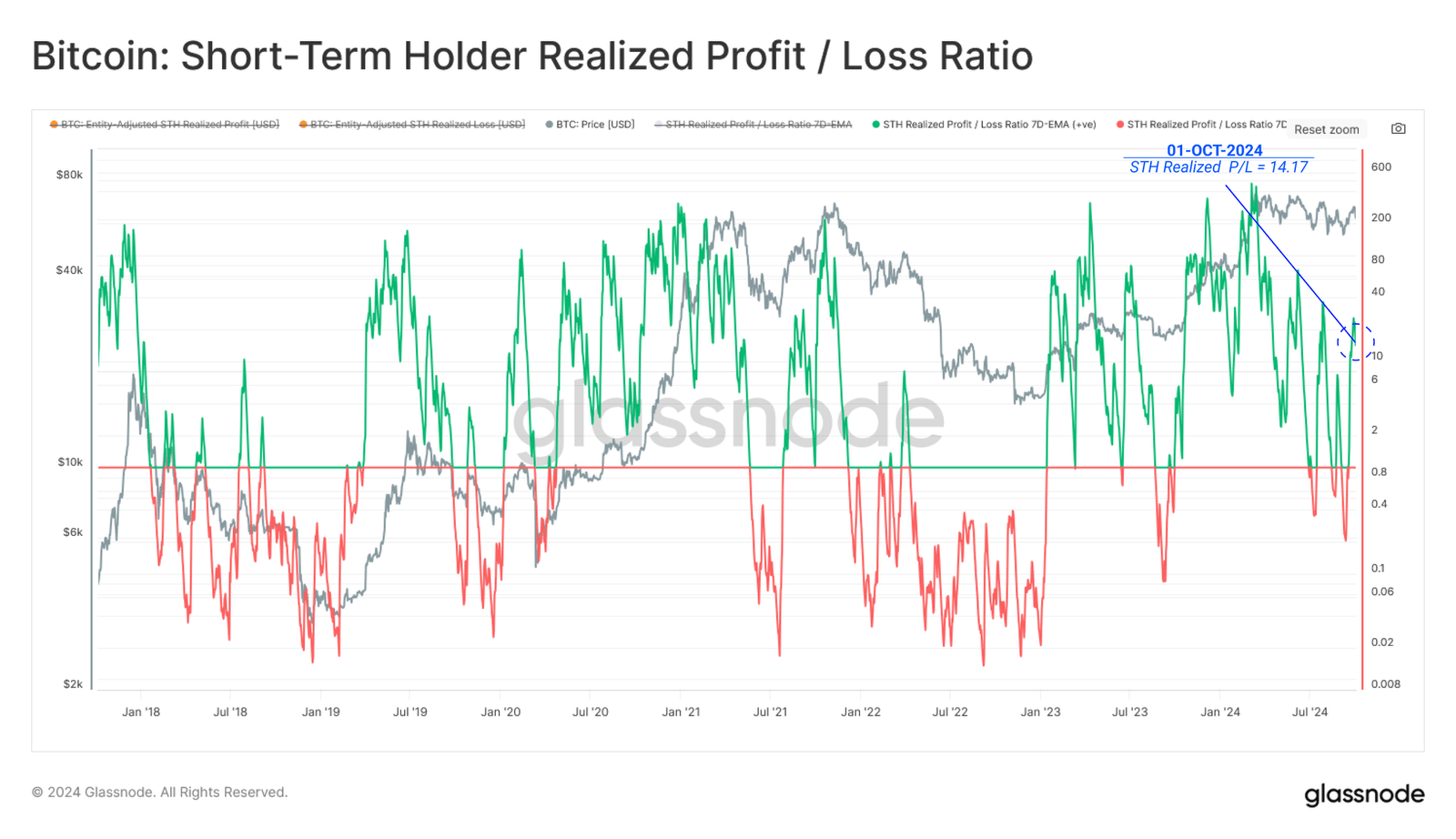

According to the latest weekly report from Glassnode, the short-term holders have started taking profits again recently. The on-chain indicator of relevance here is the “Realized Profit/Loss Ratio,” which, as its name implies, tells us about how the profit and the loss volumes being moved by Bitcoin investors currently compare.

When the value of this metric is greater than 1, it means the average holder on the network is moving their coins at a net profit. On the other hand, the indicator being under this threshold suggests loss-taking is the dominant form of selling in the market.

In the context of the current topic, the Realized Profit/Loss Ratio of only a segment of the BTC userbase is of interest: the short-term holders (STHs). The STHs refer to the Bitcoin investors who purchased their coins within the past 155 days.

Below is the chart shared by the analytics firm in the report, which shows the trend in the Bitcoin Realized Profit/Loss Ratio for the STHs over the last few years.

As displayed in the graph, the Bitcoin Realized Profit/Loss for the STHs had dropped into the negative territory early last month as the price of the cryptocurrency had crashed. This means that these investors had been scared into selling at a loss by the price plunge.

With the asset’s value recovering since the bottom, though, the indicator has also reversed its direction, assuming positive values. The latest levels have been especially high, with the STHs’ profit-taking volume being around 14 times the loss-taking one.

From the graph, it’s visible that high profit-taking from these investors generally aligns with at least local tops in the Bitcoin price, so the coin’s latest drop may also be a result of all the profit realization that this cohort has recently been participating in.

In contrast, capitulation from the STHs can lead toward bottoms, so when the STH Realized Profit/Loss switches direction again, it could be the signal that the coin may be close to reaching a low.

In the same report, Glassnode has also talked about the situation of the Bitcoin long-term holders (LTHs), who make up the rest of the Bitcoin userbase. It would appear that the percentage of supply held in loss by the cohort has spiked recently.

This recent spike could be a product of the fact that the top buyers now belong to this cohort, who are naturally holding a loss right now. Despite 47.4% of the LTH supply being underwater, though, the actual scale of unrealized loss held by the group is still negligible.

BTC Price

At the time of writing, Bitcoin is floating around $60,400, down more than 5% over the last seven days.

On-chain data shows the Bitcoin short-term holders have recently moved over 14 times as much profit volume as the loss one. Bitcoin Has Plunged As Short-Term Holders Have Been Realizing Gains According to the latest weekly report from Glassnode, the short-term holders have started taking profits again recently. The on-chain indicator of relevance here is

Amazon’s journey from a modest online bookstore to the world’s largest online retailer is a narrative of innovation, disruption, and relentless ambition. Today, Amazon dominates the e-commerce landscape, setting the standard for online shopping with its vast product selection, lightning-fast delivery, and customer-centric approach. This article explores the evolution of Amazon’s leadership in online shopping, examining the key strategies, innovations, and challenges that have shaped its rise to the top.

The Early Days: From Bookstore to Everything Store

Amazon was founded by Jeff Bezos in 1994 as an online bookstore, capitalizing on the internet’s potential to reach a global audience. The decision to start with books was strategic; books were easy to ship, did not require much storage space, and had a universal appeal. From the beginning, Bezos envisioned Amazon as more than just a bookstore. His long-term goal was to create the “everything store,” a one-stop-shop where customers could find and purchase anything they needed online.

The initial success of Amazon was driven by its innovative approach to e-commerce. While traditional bookstores were limited by physical space, Amazon offered an extensive catalog of books that was virtually limitless. The company’s early focus on customer satisfaction, with features like customer reviews, personalized recommendations, and a user-friendly interface, set it apart from competitors.

By 1997, Amazon had gone public, and its rapid growth continued. The company began to expand its product offerings beyond books, gradually adding categories like music, electronics, and toys. This diversification was essential to Amazon’s strategy of becoming the go-to online retailer for all consumer needs. The company’s ability to offer a wide range of products, combined with its commitment to customer service, established it as a leader in online shopping.

Innovation and Expansion: The Prime Revolution

One of the most significant milestones in Amazon’s evolution was the launch of Amazon Prime in 2005. For an annual fee, Prime members received free two-day shipping on eligible purchases, a proposition that was revolutionary at the time. The introduction of Prime was a game-changer, transforming customer expectations and further solidifying Amazon’s leadership in online shopping.

Prime was more than just a shipping service; it was a strategic move to create customer loyalty. The subscription model incentivized customers to make Amazon their default shopping destination, as the more they used Prime, the more value they received. Over time, Amazon expanded the benefits of Prime to include streaming video and music, exclusive deals, and other perks, making it an indispensable service for millions of customers.

The success of Prime can be measured by its membership numbers, which have grown exponentially over the years. As of 2024, Amazon Prime has over 200 million members worldwide, a testament to the value it offers. The Prime membership model has been so successful that it has influenced the broader retail industry, with many competitors launching their own subscription services in response.

The Technology Edge: Fulfillment and Logistics

Amazon’s dominance in online shopping is not just a result of its vast product selection and customer-centric approach; it is also rooted in its technological prowess. The company has invested heavily in building a state-of-the-art fulfillment and logistics network, which has been a critical factor in its ability to offer fast, reliable delivery to customers.

Amazon’s fulfillment centers, which are strategically located around the world, are marvels of automation and efficiency. These facilities use advanced robotics, artificial intelligence, and data analytics to manage inventory, process orders, and ship products with unparalleled speed. The company’s ability to deliver products quickly and accurately is a key reason why customers choose Amazon over other online retailers.

In addition to its fulfillment centers, Amazon has developed a vast logistics network that includes its own fleet of planes, trucks, and delivery vehicles. The company’s investment in logistics has allowed it to reduce its reliance on third-party carriers like UPS and FedEx, giving it greater control over the delivery process. This vertical integration has enabled Amazon to offer services like same-day and next-day delivery, further enhancing its competitive advantage.

Moreover, Amazon’s logistics innovations extend beyond its own operations. The company’s delivery service partner (DSP) program has created opportunities for small businesses to operate delivery routes for Amazon, while its crowd-sourced delivery platform, Amazon Flex, allows individuals to deliver packages using their own vehicles. These initiatives have expanded Amazon’s delivery capacity and ensured that it can meet the growing demand for fast shipping.

Expanding the Ecosystem: Marketplace and AWS

Another key component of Amazon’s success in online shopping is its ability to create a comprehensive ecosystem that extends beyond retail. The Amazon Marketplace, launched in 2000, has been instrumental in expanding the company’s product selection and driving revenue growth. The Marketplace allows third-party sellers to list their products on Amazon’s platform, giving customers access to a wider range of goods and enabling Amazon to earn a commission on each sale.

The success of the Marketplace has been staggering. Today, over half of the products sold on Amazon are from third-party sellers, many of whom are small and medium-sized businesses. The Marketplace has also been a critical factor in Amazon’s global expansion, as it allows sellers from around the world to reach customers in different markets without the need for a physical presence.

In addition to the Marketplace, Amazon Web Services (AWS) has played a crucial role in the company’s growth and profitability. Launched in 2006, AWS offers cloud computing services to businesses, allowing them to store data, run applications, and scale their operations with ease. AWS has become the backbone of the internet, powering everything from startups to large enterprises. The revenue generated by AWS has given Amazon the financial flexibility to invest heavily in its retail operations, including its logistics network, Prime, and original content for Prime Video.

Challenges and Criticisms

While Amazon’s leadership in online shopping is undeniable, it has not been without challenges and criticisms. The company’s dominance has raised concerns about its impact on competition, with critics arguing that Amazon’s scale and market power give it an unfair advantage over smaller retailers. There have also been concerns about the treatment of workers in Amazon’s fulfillment centers, with reports of grueling conditions and low wages sparking public outcry and calls for better labor practices.

Amazon has also faced scrutiny over its impact on the environment. The company’s rapid delivery services, which require a vast logistics network, contribute to carbon emissions and environmental degradation. In response, Amazon has pledged to achieve net-zero carbon emissions by 2040 and has invested in renewable energy and electric vehicles to reduce its environmental footprint.

Despite these challenges, Amazon continues to grow and innovate, constantly pushing the boundaries of what is possible in online shopping. The company’s ability to adapt to changing consumer preferences, invest in technology, and create a seamless shopping experience has ensured its position as the leader in e-commerce.

The Future of Amazon in Online Shopping

As Amazon looks to the future, it faces both opportunities and challenges. The rise of new technologies like artificial intelligence, machine learning, and automation will continue to shape the e-commerce landscape, and Amazon is well-positioned to leverage these innovations to enhance its operations and customer experience.

The company is also likely to continue expanding its ecosystem, integrating its retail operations with other services like AWS, Prime Video, and Alexa. This integration will further entrench Amazon in the daily lives of consumers, making it even more difficult for competitors to challenge its dominance.

In conclusion, Amazon’s leadership in online shopping is the result of a relentless focus on customer satisfaction, innovation, and scale. From its early days as an online bookstore to its current status as a global e-commerce giant, Amazon has consistently pushed the boundaries of what is possible in retail. As the company continues to evolve, it will undoubtedly remain a dominant force in the world of online shopping, shaping the future of commerce for years to come.